|

Photo: Stockfile/FIS

Norwegian Mackerel Prices to Korea Skyrocket, Doubling Within a Year

SOUTH KOREA

SOUTH KOREA

Friday, September 05, 2025, 07:00 (GMT + 9)

Explosive Demand from Asia and Reduced Quotas Push Export Values to a Record High, Squeezing Korean Market

OSLO—The price of Norwegian frozen mackerel exported to South Korea has nearly doubled in just one year, driven by a perfect storm of soaring Korean demand and tightening global supplies. According to a new report from Union Forsea Corp., the average export price per kilogram surged from $2.26 in September 2024 to $4.35 in September 2025, a staggering increase for one of Korea's most popular fish species.

.jpg)

The price hike is a direct result of a significant supply-demand imbalance. In the first seven months of 2025, frozen mackerel imports into Korea reached 39,292 tonnes, a 54% increase from the 25,554 tonnes imported during the same period in 2024. The surge was most dramatic in July, with imports skyrocketing by 539% year-on-year. This explosive demand is likely fueled by a sharp drop in Korea's domestic mackerel catch, which has seen stocks decline over recent years, forcing the country to rely more heavily on imports to meet consumer needs.

Global Supply Squeeze and Local Market Impact

The issue is not limited to Norway and Korea. Industry experts indicate that global mackerel prices have continued to climb amid ongoing supply pressure. A primary factor is the continued reduction in fishing quotas across the Northeast Atlantic, which has forced prices upward for all major fishing nations. For example, the total mackerel quota for the UK, EU, and Norway was significantly reduced in 2025 to ensure the long-term sustainability of the stock. This has created a tighter market, where a major buyer like Korea must pay a premium to secure supply.

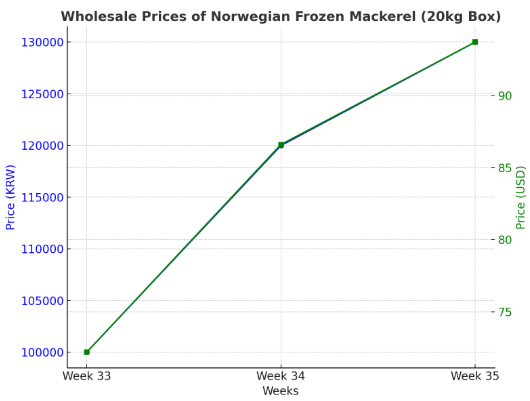

The price spike at the wholesale level is already being felt in Korea. Wholesale prices for a 20 kg box of Norwegian frozen mackerel jumped from KRW 100,000 ($72.2) in week 33 to KRW 120,000 ($86.6) in week 34, a 20% increase. By week 35, prices had climbed again to KRW 130,000 ($93.7), marking a further 8.3% rise. This volatility highlights the vulnerability of the Korean seafood market, which has a high dependence on imports.

As one Union Forsea analyst explained, "This is a typical case of supply-demand imbalance, driven more by absolute growth in demand than by a decline in supply. With Korea’s high dependence on imports, the market has been hit directly by soaring prices.” The development underscores the growing importance of ensuring stability in Korea’s seafood supply chain to manage future price volatility.

Related News:

[email protected]

www.seafood.media

|