|

A digitally integrated ecosystem where vessel behavior, environmental data, and regulatory compliance are tracked, analyzed, and optimized in near rea

China's Distant-Water Fleet Embraces AI and 5G in Major Modernization Drive for Squid and Tuna Fisheries

CHINA

CHINA

Wednesday, June 04, 2025, 00:10 (GMT + 9)

Beijing's ambitious technological integration aims to enhance efficiency, bolster sustainability, and cement its position in the evolving global seafood industry.

BEIJING – China is rapidly transforming its vast distant-water fishing (DWF) fleet, with a significant push to integrate cutting-edge technologies like artificial intelligence (AI), 5G connectivity, and electronic monitoring systems. This modernization drive, particularly focused on crucial squid and tuna operations, seeks to dramatically improve operational efficiency, ensure sustainable practices, and solidify China's influence in the international seafood market.

(1).jpg)

New series of squid jigging vessels

The Chinese government is at the forefront of this digital revolution within its DWF sector. Initiatives include the development of the BeiDou intelligent monitoring application system, specifically tailored for distant-water fisheries. Complementing this, substantial investments are being made in video surveillance and advanced electronic monitoring equipment to enhance oversight of fishing activities. Pilot programs are already underway for key fish species and regional vessels, with an impressive 20% of China's extensive tuna fleet—over 100 vessels—now equipped with electronic monitoring systems.

To facilitate real-time data exchange vital for these systems, China is aggressively deploying 5G technology along its coastline. For instance, China Unicom Guangdong, in partnership with Huawei, has implemented the 5G MetaAAU system in Yangjiang. This infrastructure provides robust connectivity, delivering stable downlink speeds exceeding 400 Mbps within 30 km offshore and maintaining speeds of 60 Mbps up to 61 km from the coast, enabling seamless data transmission between vessels and onshore facilities.

China's DWF fleet has witnessed exponential growth in its squid and tuna harvests. In 2022, the fleet's squid catch alone reached approximately 1.1 million metric tons, a monumental increase from just 30,000 metric tons in 1998. Squid now accounts for 33% of the total distant-water catch, with tuna contributing 14.8%. To manage this expansion responsibly, China has already implemented measures such as capping the number of squid-jigging vessels and imposing closed seasons in crucial fishing grounds to allow for stock replenishment.

A key strategic shift is also underway to process a larger proportion of the DWF catch domestically. In 2022, over 70% of the catch was repatriated for processing, with cities like Zhoushan and Fuzhou offering incentives to encourage this practice. This move not only stimulates local economies but aligns with China's broader ambition of becoming a central hub for global seafood processing and trade.

Zhoushan DWF port and facilities

The modernization of China's DWF fleet carries significant global implications for sustainability and international fisheries management. The nation is an active participant in regional fisheries management organizations (RFMOs) and has supported resolutions such as the Indian Ocean Tuna Commission’s electronic monitoring standards. Furthermore, China is committing to scientific surveys and fostering collaboration with other nations to assess and manage fishery resources responsibly.

A Global Shift: Smart Fleets, Smarter Oceans?

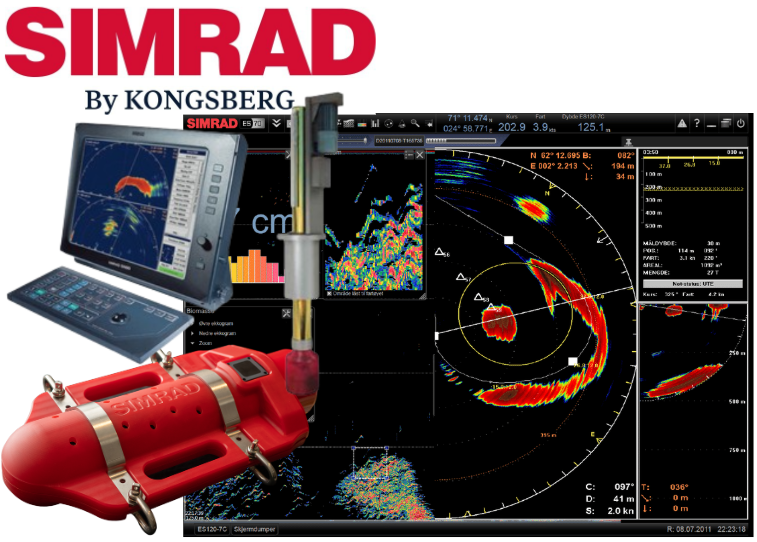

While China is at the forefront of scaling smart fishing technologies, it is part of a wider global movement. Norway, a recognized leader in responsible fisheries, is heavily investing in the digital transformation of its fleet. Norwegian research institutions and leading marine tech firms, such as Kongsberg and Simrad, are collaborating on advanced systems that integrate AI with sonar and navigation. Their efforts focus on AI-driven sonar interpretation, automated catch handling, and real-time environmental monitoring, all aimed at optimizing fishing routes and minimizing bycatch. Pilot programs further combine machine learning, hydroacoustic data, and satellite telemetry to enhance the precision of pelagic fishing, significantly improving efficiency, ensuring sustainability quotas are met, and reducing fuel consumption.

Fishing lfeet at Zhoushan area

Countries like Japan, South Korea, Spain, and Iceland are also actively exploring similar smart fleet strategies. This convergence of AI, 5G connectivity, and real-time ocean analytics is poised to redefine the economics of commercial fishing worldwide. These technologies promise:

- Improved catch targeting, significantly reducing bycatch and increasing species selectivity.

- Lower fuel consumption through optimized routes and minimized idle vessel time.

- Transparent supply chains via electronic monitoring and automated reporting.

- Stronger environmental compliance, with smart systems aiding in the enforcement of closed areas, quotas, and legal fishing practices.

What was once a highly manual, experience-based industry is evolving into a digitally integrated ecosystem where vessel behavior, environmental data, and regulatory compliance are tracked, analyzed, and optimized in near real-time. As nations compete and collaborate over ocean resources, these technological shifts will not only enhance economic competitiveness but are also set to reshape geopolitical dynamics in global seafood trade. Smart fishing isn’t merely a technological upgrade—it represents a structural transformation of how humanity harvests the sea.

[email protected]

www.seafood.media

|