|

Image: Stockfile FIS

Northern Shrimp Season Experiences Ups and Downs

ARGENTINA

ARGENTINA

Thursday, April 25, 2024, 01:00 (GMT + 9)

There are 64 pole fishing vessels that are operating, mostly freezers, and the catches vary, going from zero to five or ten tons per day. Fortunately, most of it is L1, a size that is in demand in the international market and is currently offered at the Barcelona fair.

Since the beginning of the shrimp season (Pleoticus Muelleri) in the north, the catches were irregular, with days in which some boats made 5 tons, others 10 tons and the next day nothing or in the same area some found the shrimp and others did not. Apparently there are pulses of the shoal that escape the closed area. Despite this, some have managed to gather a considerable stock to offer at the Barcelona fair, where so far there are only inquiries, although it has just started and there are hopes in the business sector of making sales.

Source: Stockfile FIS

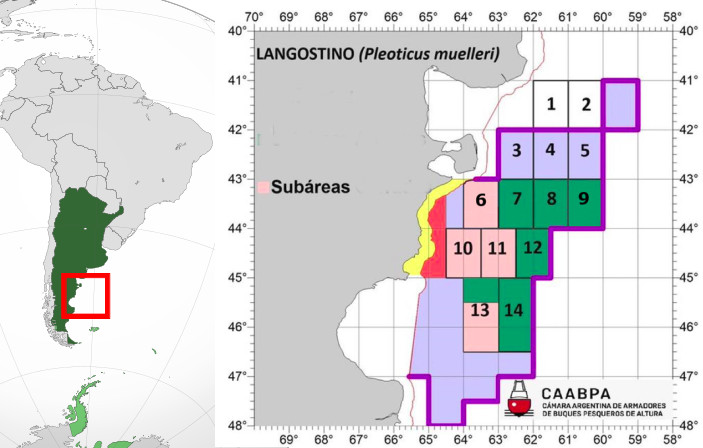

In 2021, shrimp catches in the northern sector outside the closed season, in subareas 1 and 2, were extraordinary; but last year and especially this year the same results are not being observed. The climate conditions and food available in the environment could be determining that small concentrations are found that appear in certain areas and for a short term.

Regarding yields, it is estimated that the capture per unit of effort would reach a thousand kilos, resulting in days of 5 tons of capture, others of 10 tons and due to these special conditions of the distribution of the resource, there are days in which that nothing is caught or there are also situations in which, while one boat achieves good production, another that is a short distance away cannot find the resource.

.jpg)

Source: Stockfile FIS

Given this situation of so many ups and downs, what the researchers observed in the campaign gives some peace of mind, given that they found conditions similar to those observed in previous years, when the final result of the season in national waters was good. At least based on the latest data that was accessed, because with the lack of functioning of the Federal Fisheries Council, information of great relevance to the industry is not available.

The campaigns allow us to know if there will be availability of a resource accessible to fishing; What cannot be known is where it will be, since that depends on environmental factors. Historically, there was a more orderly distribution that started in the south and followed it towards the north, but in recent years finding concentrations of shrimp has been more complicated and boats have to search for them. It is a dynamic that, as researchers have said on many occasions, is here to stay.

Source: Revista Puerto

According to the satellite monitoring report, there are a total of 64 pole vessels in operation that are concentrated in quadrant 4160 and the vast majority are located on the outer edge of the closure. The number of freshwater tangon boats has been almost zero, only one based in Puerto Mardryn; Therefore, despite the proximity, the Mar del Plata plants could not have raw materials to process.

In terms of size, the largest proportion is of good-sized specimens with a significant proportion of L1, a size of shrimp frozen on board that is in demand in the markets and that some have taken the opportunity to offer at the fishing fair that has been taking place since yesterday in Barcelona.

.jpg) One of them is Fernando Álvarez Castellano, CEO of Conarpesa, who celebrates the fact that the season has opened in the north so as not to arrive with nothing in the Catalan metropolis: “For us it has been positive, especially because 60 % is from L1, for which there is demand. We already have 500 consolidated tons and several containers that are coming to Spain to sell to our clients and it allowed us to have something to offer at the fair; We still do not have a price, there are inquiries, but we hope that starting tomorrow we will begin to set a price and see if we can have a closed operation. One of them is Fernando Álvarez Castellano, CEO of Conarpesa, who celebrates the fact that the season has opened in the north so as not to arrive with nothing in the Catalan metropolis: “For us it has been positive, especially because 60 % is from L1, for which there is demand. We already have 500 consolidated tons and several containers that are coming to Spain to sell to our clients and it allowed us to have something to offer at the fair; We still do not have a price, there are inquiries, but we hope that starting tomorrow we will begin to set a price and see if we can have a closed operation.

According to INDEC export data for the month of February, whole shrimp have been sold at an average price of 5,144 dollars per ton and specifically the Spanish market had an average value of 5,072 dollars per ton, a floor that they hope to surpass.

Improving the commercial conditions of shrimp is a challenge that is limited by the offers of farmed shrimp that invade the market with prices that are impossible to match and quality and traceability are not always enough to achieve a better positioning. But it is not only commercial issues that worry the sector but also the disorganization within the fishing administration, which can complicate the season.

.jpg)

Fuente: Archivo FIS

Less than a month before the season begins in national waters within the Permanent Hake Ban, the sector is moving blindly. The INIDEP reports are presented to the Undersecretary of Fisheries, but there is no scope for discussion to present the results and resolve the measures that should be taken, because the Federal Fisheries Council has not yet been formed—and by decision of the National Executive Branch. . A situation that is expected to be resolved as soon as possible, since otherwise the complications will begin to increase.

Author: Karina Fernández | Revista Puerto (Translated from the original in Spanish)

.png)

[email protected]

www.seafood.media

|

|