|

Photo: Illustrative by FIS

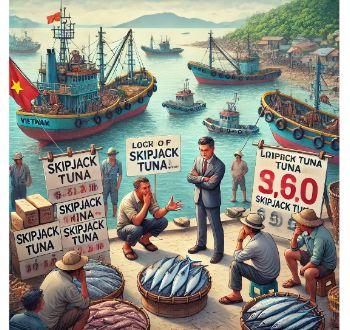

Addressing the Challenges Facing Vietnam's Tuna Industry

VIET NAM

VIET NAM

Wednesday, January 15, 2025, 00:10 (GMT + 9)

In 2024, Vietnam's tuna exports to Portugal showed notable growth, marking a shift from the irregular exports of 2023.

.png) According to Vietnam Customs, tuna exports to Portugal reached approximately USD 10 million in 2024, a remarkable 379% increase compared to the previous year. This growth was reported by Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP). According to Vietnam Customs, tuna exports to Portugal reached approximately USD 10 million in 2024, a remarkable 379% increase compared to the previous year. This growth was reported by Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP).

Portugal is currently the sixth-largest EU importer of Vietnamese tuna. In 2024, it stood out as one of the few EU countries to increase tuna imports from Vietnam at a triple-digit rate.

Key Products and Market Dynamics

The primary export product to Portugal is frozen steamed tuna loins, which account for over 82% of the total export value, with frozen tuna meat/loins making up the remainder.

Geographically, Portugal’s strategic location in southwestern Europe makes it a key gateway to global trade, positioned at the crossroads of Europe, Africa, and Latin America. This advantage has led Spanish importers to increasingly use Portuguese ports for re-exporting goods, particularly to Vigo, Spain.

In 2024, Portugal notably boosted its imports of processed tuna products from Vietnam, especially frozen steamed tuna loins. These orders were primarily temporary imports intended for re-export to other European and African markets.

.jpeg)

Source: VASEP. Click on the image to enlarge

Vietnamese tuna exporters have also benefited from tariff incentives under the EU-Vietnam Free Trade Agreement (EVFTA), leveraging these advantages to enhance their market competitiveness. However, export orders to Portugal have faced interruptions since December 2024.

Challenges at the Start of 2025

The Vietnamese tuna industry is grappling with several difficulties that threaten its growth trajectory.

-

Export Slowdown Across Markets

Exports to Portugal and other key markets have slowed due to challenges in obtaining SC (source certificate) and CC (catch certificate) documentation. Despite Prime Minister Pham Minh Chinh’s issuance of Official Dispatch No. 127/CD-TTg on December 5, 2024, aimed at streamlining certification processes, local authorities’ inconsistent and overly rigid application of regulations has created backlogs. This has disrupted production and export activities for seafood businesses.

-

Tariff Quota Reset Under EVFTA

From January 1, 2025, the preferential tariff quota under EVFTA was reinstated. However, with the offshore fishing season underway, many skipjack tuna fishing boats in key provinces remain docked due to low fish sizes not meeting the regulatory minimum of 50 cm under Decree No. 37/2024/ND-CP. Fishermen are reluctant to go to sea, citing unprofitable purchasing prices, high fuel costs, and low wages.

Consequently, businesses cannot source skipjack tuna with the required origin documentation to qualify for tax incentives. This creates a risk of losing market share, as importers may turn to alternative suppliers, such as the Philippines, Ecuador, or Thailand, which also enjoy favorable trade terms. Thailand, in particular, is actively negotiating a Free Trade Agreement with the EU, intensifying competition.

Photo: VASEP

Urgent Need for Policy Adjustments

The current situation poses significant risks to both fishermen and businesses. Without an adjustment to the minimum allowable size for skipjack tuna, the industry faces the dual threat of lost income for fishermen and diminished market share for exporters. Reclaiming lost markets in such a competitive environment is a challenging task. Thus, swift action is needed to revise regulations and stabilize the supply chain, ensuring the sustainability of Vietnam’s tuna industry.

Related News:

.jpg)

[email protected]

www.seafood.media

|

|