|

While overall imports of Norwegian seafood have declined, certain products have seen significant increases, indicating shifting market trends

South Korean Imports of Norwegian Seafood Decrease by 8% Through September 2024 (Mackerel and Salmon Trade Data)

SOUTH KOREA

SOUTH KOREA

Friday, October 11, 2024, 01:20 (GMT + 9)

As of September 2024, South Korea's imports of Norwegian seafood have declined by 8% compared to the previous year.

In September alone, South Korea imported 3,385 tons of Norwegian seafood, marking an 11% increase from 3,038 tons in September 2023. However, cumulative imports for 2024 reached 51,073 tons, down from 55,420 tons during the same period last year. Norwegian seafood accounted for 8% of total seafood imports, which amounted to 651,137 tons.

- Frozen mackerel imports totaled 23,484 tons, reflecting a 16% decrease from 27,941 tons last year.

- Fresh salmon imports reached 12,029 tons, an 11% decline, while fresh salmon fillet imports decreased by 8% to 3,356 tons.

- Frozen mackerel fillets saw a significant drop of 26%, with 3,347 tons imported. In contrast, fresh Atlantic salmon imports surged by 221% to 2,702 tons, up from 843 tons last year.

In terms of value, Norwegian seafood imports in September 2024 were valued at USD 37.52 million, a 16% increase from USD 32.21 million in the same month of 2023. However, the cumulative import value for 2024 was USD 397.92 million, reflecting a 7% decrease from USD 429.08 million in 2023. The average import price rose slightly to USD 7.79/kg, an increase of 0.6% from USD 7.74/kg the previous year. While overall imports of Norwegian seafood have decreased, certain products have experienced significant growth, indicating shifting market trends.

Sharp Increase in Frozen Mackerel Imports in September 2024

In September 2024, the volume of frozen mackerel imported into South Korea saw a notable rise compared to the same period last year. According to the Ministry of Oceans and Fisheries, a total of 187 tons of frozen mackerel were imported in September, marking a 290% increase from the 48 tons imported in September 2023.

Despite this substantial monthly increase, cumulative imports through September 2024 amounted to 25,825 tons, representing a 24% decrease from the 33,926 tons imported during the same period in 2023. This accounts for 4% of the total seafood imports for the year.

Norway was the primary supplier, providing 82% of the imports with 23,484 tons, followed by China with 1,441 tons (10.7%), the Netherlands with 757 tons, and Germany with 95 tons. The import prices per kilogram were USD 2.23 from Norway, USD 1.97 from China, USD 1.48 from Taiwan, and USD 2.03 from the Netherlands.

The total value of frozen mackerel imports for September 2024 was approximately USD 510,000, with the cumulative value for the year reaching USD 73.55 million, an 18% decline from USD 89.42 million recorded during the same period last year. The average import price in 2024 was USD 2.17/kg, down 9% from USD 2.39/kg in 2023.

The increase in frozen mackerel imports is expected to benefit domestic consumers by stabilizing prices and potentially boosting demand.

For reference, the domestic wholesale price of frozen mackerel in South Korea, specifically for Norwegian-origin, 400/600 size, 20kg, purse seine operation, is currently trading at 97,000 KRW.

Norwegian Fresh Salmon (1st Week of October 2024)

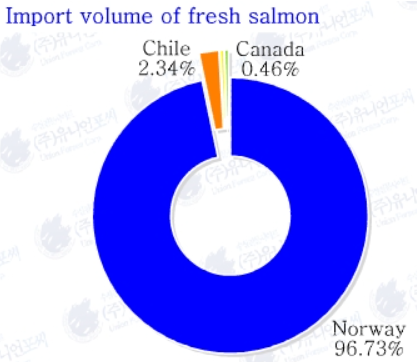

As of October 10, 2024, South Korea's cumulative imports of fresh salmon totaled 19,398 tons, nearly identical to the 19,315 tons imported during the same period in 2023. However, the total import value dropped by nearly 10%, with USD 273.25 million recorded this year, down from USD 302.60 million in 2023. As of October 10, 2024, South Korea's cumulative imports of fresh salmon totaled 19,398 tons, nearly identical to the 19,315 tons imported during the same period in 2023. However, the total import value dropped by nearly 10%, with USD 273.25 million recorded this year, down from USD 302.60 million in 2023.

Most of the imports came from Norway, which supplied 18,737 tons, while Chile contributed 453 tons and Canada provided 90 tons. In terms of import prices, Norway had the highest at USD 13.87/kg, followed by Chile at USD 12.39/kg, and Canada at USD 12.23/kg, the lowest among the three.

This trend highlights the steady volume of imports despite a notable drop in overall import value.

.png)

Source: Union Forsea Corp.

[email protected]

www.seafood.media

|