|

The EUMOFA is a market intelligence tool on the European Union fisheries and aquaculture sector

EU Fisheries Market Report 2023: Inflation seriously affects aquatic product consumption and exports

EUROPEAN UNION EUROPEAN UNION

Friday, December 01, 2023, 07:00 (GMT + 9)

The European Union Fisheries and Aquaculture Market Observation Organization (EUMOFA) released the annual report "EU Fisheries Market", which conducted a comprehensive analysis of the status of the EU fisheries and aquaculture industry.

Report Highlights

Higher prices, lower consumption

Household spending on fisheries and aquaculture products in the 27 EU countries will surge by nearly 11% in 2022 compared with 2021, accelerating an upward trend that began in 2018.

The escalating inflation has had a significant impact on food prices (especially aquatic products), causing their prices to increase by more than 10% compared with 2021. Inflation has led to a sharp reduction in household fish consumption, with consumption in the highest-consuming EU countries falling by almost 17%, according to Europanel/Kantar/GfK data.

The impact of inflation on exports

EU exports increased by 19% to 8.1 billion euros. However, production continued its downward trend in 2021, falling 5% to 2.3 million tonnes.

Several factors influence EU trade volumes in 2022. Mainly a surge in inflation, linked to increased demand and consequent price increases due to the end of COVID-19. Furthermore, the conflict between Russia and Ukraine has had a significant impact on EU fisheries markets, as it increases energy and production costs, contributes to global inflation, and thus affects currency exchange rates.

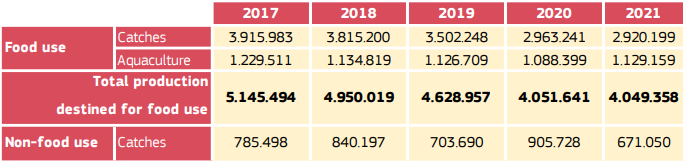

Source: EUMOFA, based on EUROSTAT (online data codes: fish_ca_main, fish_aq2a and DS-045409) and FAO data. Details on the sources and on the methodological approach used for assessing the production method of imports and exports and the destination use of catches can be found in the Methodological background. Click image to enlarge it

Import and export trade imbalance

As imports grew more than exports, the EU trade deficit reached 25%, an increase of 4.73 billion euros from 2021. From 2013 to 2022, the deficit increased by 56% in real terms.

The situation worsened in all EU countries with deficits exceeding €1 billion in 2021-2022, with exports and imports increasing in value but falling in volume in most EU countries.

Major product changes

Salmon: In 2022, EU salmon imports fell by 3% compared with 2021, but the value increased by 28%, reaching 8.4 billion euros, a ten-year high. Salmon imports from Norway accounted for 83% of the value increase in 2022, with their average import price increasing by 33% compared with 2021.

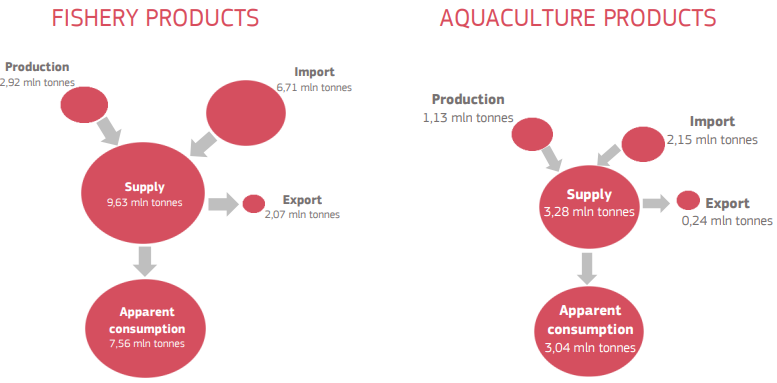

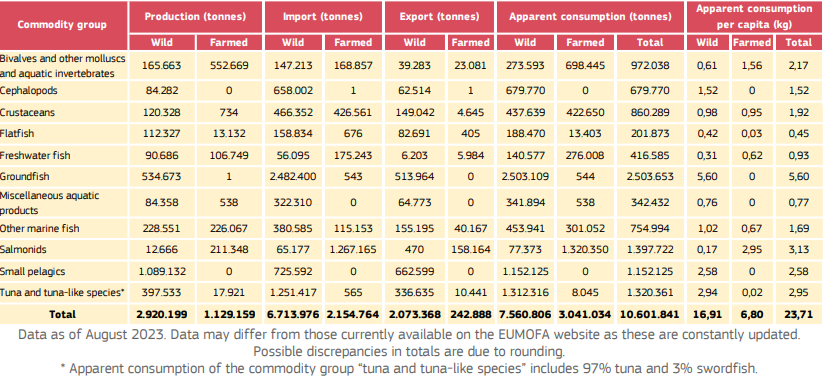

EU SUPPLY BALANCE FOR FISHERY AND AQUACULTURE PRODUCTS BY COMMODITY GROUP AND PRODUCTION METHOD (2021, LIVE WEIGHT EQUIVALENT, FOOD USE ONLY). Source: EUMOFA, based on EUROSTAT (online data codes: fish_ca_main, fish_aq2a and DS-045409) and FAO data. Details on the sources and on the methodological approach used for assessing the production method of imports and exports and the destination use of catches can be found in the Methodological background. Click image to enlarge it

Shrimp: In 2022, shrimp will account for 10% of the EU's total import volume and 15% of the EU's total import value. Compared with 2021, shrimp import volume will increase by 2% and import value will increase by 17%. In 2022, Ecuador, India and Vietnam increased their market shares by 1% to 2%, accounting for 89% of the added value of shrimp imports. On the other hand, Argentina's market share declined by approximately 3% from 2021 to 2022.

Cod: one of the most popular aquatic products among EU consumers. In 2022, the Norwegian/Russian Barents Sea cod quota will be reduced by 20%, and the EU market supply will be reduced by 7%. The average product price for cod increased by 29%, from 5.05 euros/kg to 6.53 euros/kg, resulting in a 20% surge in import values compared to 2021.

Tuna: In 2022, tuna accounted for 10% of EU fish imports by volume and value, with a 1% increase in volume and a 29% increase in import value. Compared with 2021, bonito accounted for 53% of imports by volume and 49% by value. , followed by yellowfin tuna, accounting for 32% of import volume and import value.

Alaskan pollock: Although import volumes remained stable in 2022, import values surged by 31% to 986 million euros. The increase in imports was mainly due to a sharp increase in prices.

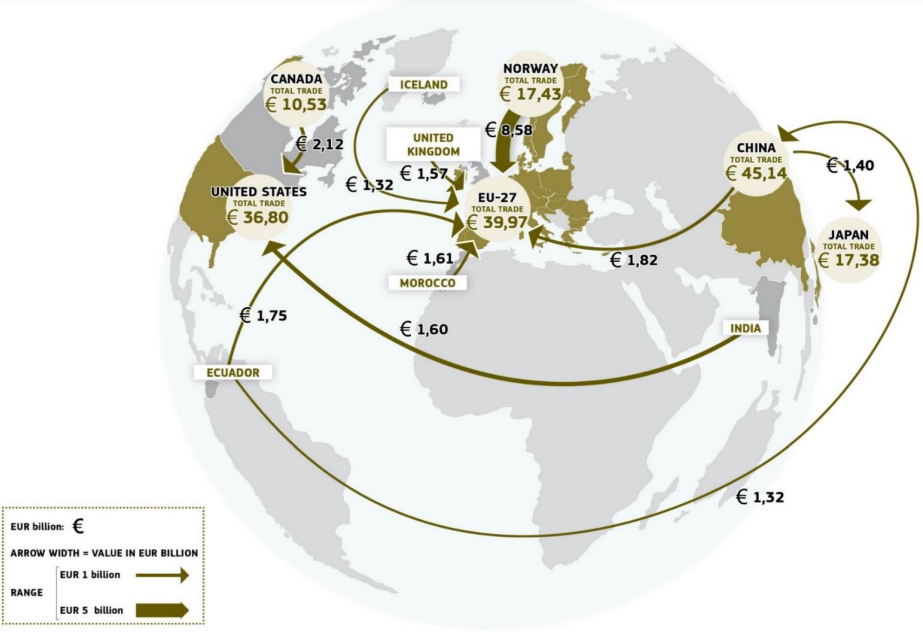

TOP-10 TRADE FLOWS IN VALUE OF FISHERY AND AQUACULTURE PRODUCTS IN THE WORLD (2022, NOMINAL VALUES) Source: EUMOFA elaboration of data from EUROSTAT (for EU trade flows, online data code DS-045409), StatBank Norway and Trade Data Monitor (for other non-EU countries). Click image to enlarge it

EU trade with China

Trade volume with China will show positive growth in 2022, with volume increasing by 7% and value increasing by 31%. The main driver of this growth was the significant increase in China's aquatic product imports, which increased by 12% in volume to 6.6 million tons and 46% in value to 22.2 billion euros. A total of 4.9 million tons of aquatic products will be exported to China in 2022, worth 23 billion euros.

Still, trade volumes with China have yet to return to pre-pandemic levels. While relatively stable compared to 2021, it is still 10% lower than in 2019.

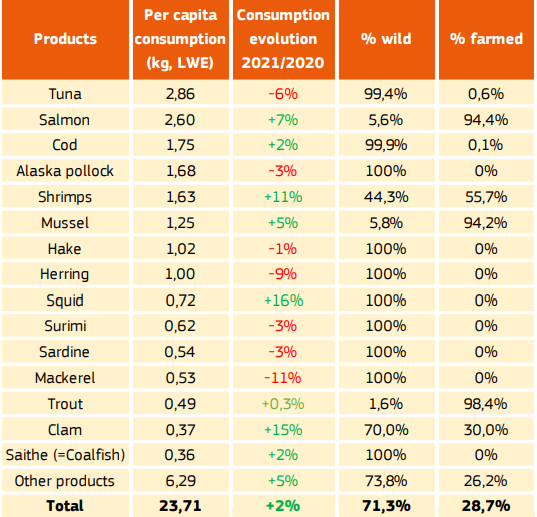

APPARENT CONSUMPTION OF TOP-15 MOST CONSUMED PRODUCTS (2021) Source: EUMOFA, based on EUROSTAT (online data codes: fish_ca_main, fish_aq2a and DS-045409) and FAO data. Details on the sources and on the methodological approach used for assessing the production method of imports and exports and the destination use of catches can be found in the Methodological background. Click image to enlarge it

Judging from the main destinations of China's aquatic products exports, 13% are exported to the European Union, 11% are exported to Japan, and 10% are exported to South Korea and the United States. The largest shares of total sales to the EU are products not intended for human consumption (37%) fishery products and Alaska pollock fillets (22%). China's main export products to Japan are frozen processing and marine fish fillets, accounting for 37% of total exports to Japan in 2022 and 26% of total exports to Japan.

"EU Fisheries Markets" is compiled by the EU Fisheries and Aquaculture Market Observer (EUMOFA) and has been published annually since 2014. EUMOFA is a market analysis agency of the European Union, set up by the European Commission. It is committed to improving market transparency and efficiency, analyzing EU market dynamics, and supporting evidence-based decision-making.

Source: Zhejiang Zhoushan International Agricultural Products Trade Center

[email protected]

www.seafood.media

|