|

Photo: VASEP/FIS

Soaring Shrimp Demand in Southern Europe, stable in other regions

VIET NAM

VIET NAM

Tuesday, December 10, 2024, 06:00 (GMT + 9)

As of November 15, 2024, Vietnam’s shrimp exports to the EU reached over $422 million, marking a 16% increase compared to the same period last year.

.jpg) The EU market has shown consistent demand for Vietnamese shrimp throughout the year, with steady growth since April, according to Kim Thu, a shrimp market expert with the Vietnam Association of Seafood Exporters and Producers (VASEP). The EU market has shown consistent demand for Vietnamese shrimp throughout the year, with steady growth since April, according to Kim Thu, a shrimp market expert with the Vietnam Association of Seafood Exporters and Producers (VASEP).

Highlights of EU Shrimp Market Trends:

- Regional Growth: Major markets, including Germany, the Netherlands, Belgium, and Denmark, recorded growth rates ranging from 11% to 29%.

- Consumption Preferences:

- Convenience-focused products such as peeled, headless shrimp dominate.

- Breaded shrimp is particularly popular in the UK, Germany, and the Netherlands.

- High-end markets like France, Spain, and Italy favor fresh shrimp, with black tiger shrimp highly consumed in France and Italy.

- Sustainability Trends: Northern Europe emphasizes shrimp with sustainability certifications, reflecting growing eco-consciousness.

- E-commerce Growth: Increasingly, consumers prefer buying frozen or ready-to-cook shrimp online, prioritizing fast delivery and e-commerce-optimized packaging.

Southern Europe: A Key Shrimp Market

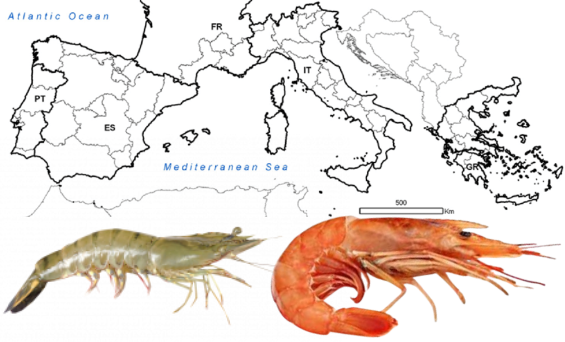

The Southern European region—spanning Spain, France, Italy, Portugal, and Greece—has emerged as Europe’s largest shrimp consumer. In 2023, these countries imported 332,000 tonnes of shrimp from outside the EU, a slight decline from the peak of 349,000 tonnes in 2021.

- Penaeus shrimp (HS03061792) accounted for 64% of imports.

- Wild-caught shrimp (HS03061799), including Argentine red shrimp and Asian pink shrimp, made up 31%, with value-added shrimp at just 3%.

The region’s vibrant dining culture, strong HORECA sector, and tourism-driven demand make it a lucrative market. While seafood distribution is fragmented within HORECA, retail through modern supermarkets and traditional seafood retailers remains pivotal.

Competitive Landscape and Challenges

Vietnamese shrimp accounts for 13% of the EU market share, facing stiff competition from India, Thailand, Ecuador, and Brazil. To maintain its edge, Vietnam has prioritized meeting the EU's stringent quality and safety standards, ensuring compliance with environmental, traceability, and animal welfare requirements.

Strategic Outlook

Southern Europe offers vast opportunities for Vietnamese shrimp exporters, particularly as the market leans towards high-quality products that meet sustainability benchmarks. As the EU serves as a barometer for global competitiveness, Vietnamese shrimp is poised to strengthen its foothold while contributing to the region’s robust seafood demand.

[email protected]

www.seafood.media

|

|