|

Photo: VASEP/FIS

Vietnam’s Canned Tuna Gains Market Share in the US

VIET NAM

VIET NAM

Wednesday, December 11, 2024, 03:30 (GMT + 9)

After nearly six months of decline, Vietnam’s canned tuna exports to the US rebounded in October 2024, signaling a positive shift in market dynamics.

.png) Export values reached nearly $12 million, marking a 16% increase compared to the same period in 2023. Cumulatively, from January to October 2024, Vietnam’s canned tuna export value exceeded $87 million, reflecting a 17% growth, according to Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP). Export values reached nearly $12 million, marking a 16% increase compared to the same period in 2023. Cumulatively, from January to October 2024, Vietnam’s canned tuna export value exceeded $87 million, reflecting a 17% growth, according to Nguyen Ha, Tuna Market Expert at the Vietnam Association of Seafood Exporters and Producers (VASEP).

The US has long been Vietnam’s largest market for canned tuna, contributing 36% of the country’s total export turnover for this product category.

Trends in US Canned Tuna Imports

While the US canned tuna import market peaked in 2022, it has since experienced significant declines. In 2024, however, overall import levels have stabilized compared to the same period last year. During this time, Asian canneries have made significant inroads into the US market.

- Thailand remains the dominant supplier, yet its import volumes to the US remain stagnant.

- In contrast, Vietnam and South Korea have expanded their market shares.

- Traditional suppliers like Mexico, Indonesia, and Ecuador have seen their shares dwindle, with Indonesian imports declining steadily over the past three years.

.png)

Source: VASEP

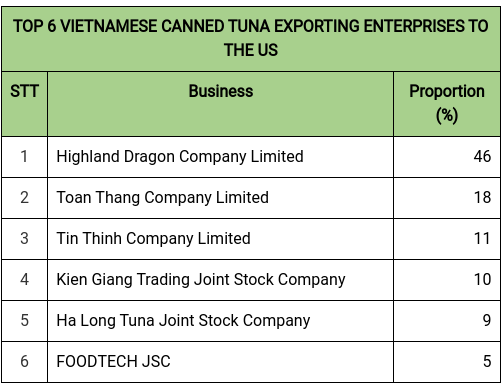

Vietnam has now surpassed Mexico to become the second-largest supplier of canned tuna to the US, behind Thailand, accounting for 12% of total import volume. Vietnamese exporters have strategically adjusted prices to remain competitive, with average prices hovering around $4,670 per ton.

Opportunities Amid Economic Recovery

The US economy is undergoing robust recovery, bolstered by rising wages and asset values. The International Monetary Fund (IMF) recently revised its growth forecast for the US upward, making it the only developed economy with improved prospects for both 2024 and 2025. This growth is driving higher domestic consumption, including increased demand for seafood products. Retail sales of seafood, including tuna, are expected to rise, creating fresh opportunities for Vietnamese exporters.

Source: VASEP

Challenges Ahead: Impact of Potential Tariffs

The re-election of former US President Donald Trump introduces uncertainty into trade dynamics. If new tariffs are imposed, including a 60-100% import tax on Chinese goods and 10-20% tariffs on products from other countries, Vietnam’s tuna exports to the US could face significant fluctuations.

In anticipation of such measures, importers may stockpile tuna, particularly canned products, to avoid higher costs. While this could lead to a short-term surge in exports, increased shipping costs could erode profit margins. Vietnamese exporters will need to adapt quickly to these changing conditions to maintain their competitive edge.

[email protected]

www.seafood.media

|