|

Photo: VASEP/FIS

Vietnam Seafood Exports Show Mixed Results in January 2025

VIET NAM

VIET NAM

Monday, February 10, 2025, 09:00 (GMT + 9)

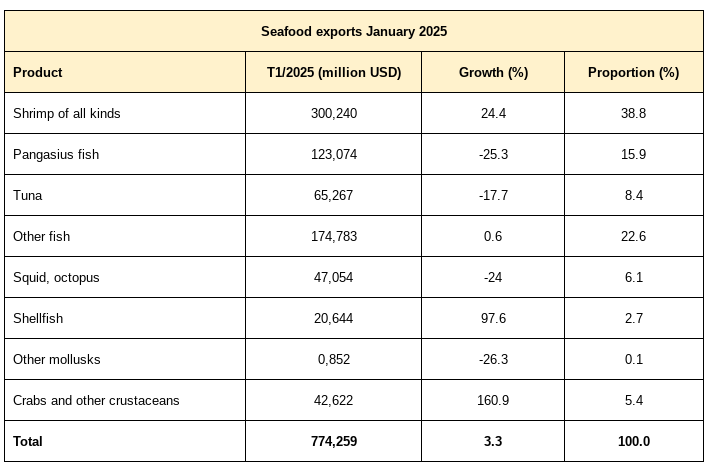

Vietnam's seafood export turnover reached US$774.3 million in January 2025, a 3.3% increase year-on-year, though comparisons with 2024 are complicated by the earlier Lunar New Year.

While shrimp exports led the growth, the sector faces challenges in key markets, reports Le Hang, Communications Director from the Vietnam Association of Seafood Exporters and Producers (VASEP)

Shrimp: Exports reached US$300 million, representing 39% of total seafood exports. Rabobank reports indicate a global shrimp market rebalancing, with production slowing and prices expected to recover in the first half of 2025, particularly with improved US and EU demand. However, declining Chinese consumption due to changing spending habits and competition from cheaper seafood poses a challenge. Shrimp: Exports reached US$300 million, representing 39% of total seafood exports. Rabobank reports indicate a global shrimp market rebalancing, with production slowing and prices expected to recover in the first half of 2025, particularly with improved US and EU demand. However, declining Chinese consumption due to changing spending habits and competition from cheaper seafood poses a challenge.

Pangasius: Despite strong price growth due to limited supply, pangasius exports face difficulties. While EU and Chinese demand remains stable, fingerling shortages and international tariff fluctuations, notably anti-dumping policies, could hinder growth. Limited supply and market volatility may increase short-term export value, but raw material shortages and tariff changes present near-term challenges.

Tuna: Exports declined 17.7% in January, but recovery is anticipated in 2025 due to steady US and EU demand. Potential tariff policy changes, especially in the US, offer opportunities for increased competitiveness. However, internal challenges remain, including incentivizing offshore fishing and streamlining S/C and C/C certificate issuance. Sustainable production models and market expansion through quality improvement and international cooperation are also crucial.

Source: VASEP. Click on the table to enlarge it

Export Markets: Significant variations in market trends were observed. While China and Hong Kong saw strong growth (64.9%), the US and EU experienced declines (16% and 17.6%, respectively). US consumption declines, potentially linked to tariffs, may impact Vietnamese seafood, though increased demand for convenient products like frozen shrimp could partially offset this. The ASEAN market showed stable growth (10.5%), highlighting its potential. Declining consumption in the Middle East and other markets necessitates strategic adjustments.

Outlook: The 2025 global seafood market is expected to be volatile, with changing consumer habits, tariffs, and supply/demand fluctuations impacting Vietnam's exports. Declining demand in key markets like China and the US poses a significant challenge. However, growth in ASEAN markets and supportive tariff policies offer opportunities. Developing value-added products, enhancing quality, and expanding export markets will be key to sustainable growth.

[email protected]

www.seafood.media

|