|

Photo: Fao Globefish /FIS

FAO-Globefish - Small Pelagics Market Overview (anchovy, herring, mackerel...)

WORLDWIDE WORLDWIDE

Friday, March 14, 2025, 22:00 (GMT + 9)

Peruvian anchovy to remain high in 2025, Norwegian mackerel and herring reach record exports in 2024, rising Small pelagics demand for small pelagic fish in Asia

Good catches of Peruvian anchovy in 2024 are expected to be matched in 2025 as the sector continues to recover from the El Niño phenomenon. Norwegian mackerel and herring saw record export values in 2024. In Asia, demand for small pelagic fish is rising.

Resource management issues

In October 2024, the Northeast Atlantic coastal States reached agreement on the 2025 Total Allowable Catch (TAC) limits for mackerel, Atlanto-Scandian herring and blue whiting at 576 958 tonnes, 401 794 tonnes and 1 447 054 tonnes, respectively. Except for a three percent increase in the case of herring, these quotas showed a decline by 22 percent (mackerel) and 5.4 percent (blue whiting) compared with the TACs in 2024. These figures are aligned with the recommendations provided by the International Council for Exploration of the Sea (ICES). However, crucial quota-sharing agreements between the coastal States sharing these resources remain elusive, leading to an overall downward trend for stock biomass in recent years, particularly mackerel and herring. In October 2024, the Northeast Atlantic coastal States reached agreement on the 2025 Total Allowable Catch (TAC) limits for mackerel, Atlanto-Scandian herring and blue whiting at 576 958 tonnes, 401 794 tonnes and 1 447 054 tonnes, respectively. Except for a three percent increase in the case of herring, these quotas showed a decline by 22 percent (mackerel) and 5.4 percent (blue whiting) compared with the TACs in 2024. These figures are aligned with the recommendations provided by the International Council for Exploration of the Sea (ICES). However, crucial quota-sharing agreements between the coastal States sharing these resources remain elusive, leading to an overall downward trend for stock biomass in recent years, particularly mackerel and herring.

Exasperated by the seeming inability of coastal States to cooperate in this matter, the North Atlantic Pelagic Advocacy Group (NAPA) has extended its fishery improvement projects (FIPs) covering pelagic stocks in the Northeast Atlantic for two more years. NAPA originally set up its FIPs to push coastal States into reaching an agreement on quotas with the caveat that some members comprising its coalition of over 50 retailers and supply chain businesses have pledged to stop sourcing from the fisheries if the issue is unresolved. The new FIPs will last through 2026, and NAPA said that they offer the latest and best chance for coastal States to sort out an equitable agreement.

Meanwhile, the Pelagic Advisory Council (PelAC), one of 11 Advisory Councils for fisheries established in the European Union, has urged the European Commission to take decisive action against unsustainable fishing practices by non-EU States, including Norway, Iceland and the Faroe Islands. PelAC also called for ICES to integrate climate change and ecosystem impacts into its future assessments.

The almost 40 percent decline in the stocks of herring over the past decade is particularly troubling. In 1965, total landings were 3.7 million tonnes but by 2022, the figure had dropped by 40 percent to 1.6 million tonnes. Nevertheless, ICES has recommended an increase in the quota for Norwegian springspawning herring from 390 010 tonnes in 2024 to 401 794 tonnes for 2025 based on indications that the resource is rebuilding.

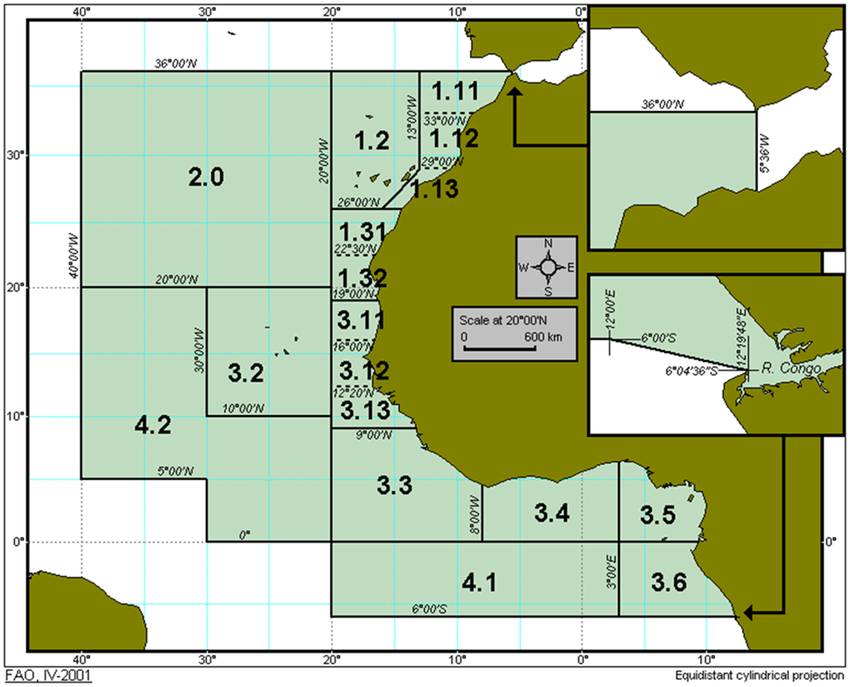

In Africa, the Joint Committee under the EU-Mauritania Sustainable Fisheries Partnership Agreement (SFPA) met in Nouakchott in December 2024. Among other matters, the European Union and Mauritania looked at a report issued by the Eastern Central Atlantic (CECAF) working group on the state of small pelagic resources off the coast of North-West Africa. The report shows that five out of nine small pelagic stocks – sardine, round sardinella, flat sardinella, Atlantic horse mackerel and bonga shad (Ethmalosa fimbriata) – are overexploited. It recommends an immediate reduction in the fishing effort; extending the ban on the use of sardinella for fishmeal production throughout the sub-region; and suggests actions such as biological rest, zoning, setting minimum sizes and capacity management.

Area covered and Members States of CECAF -Fishery Committee for the Eastern Central Atlantic. ATLANTIC, EASTERN CENTRAL (FAO Major Fishing Area 34)

Anchovy

The Peruvian Ministry of Production (PRODUCE) reported that 95 percent of the anchovy 2024 catch quota of 2.51 million tonnes was exceeded in its second season, primarily from the north-central region. A total of USD 1.4 billion in exports, mainly fishmeal, was generated for the country. On 24 January 2025, this fishery was closed to protect the spawning stock.

Herring

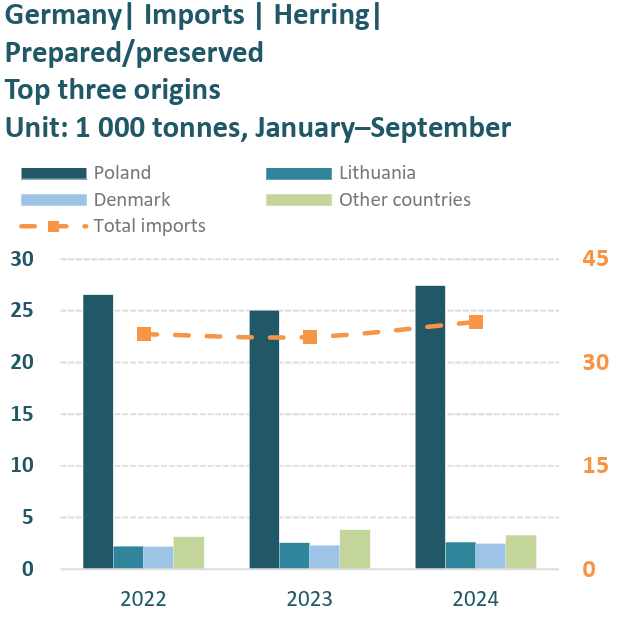

Although 2024 Norwegian exports of herring, at 227 916 tonnes, were down slightly from the 2023 figure, it was a record high year in terms of value (NOK 4.2 billion). A price increase of about 17 percent was seen for 14 herring products, particularly skinless frozen fillets and whole frozen fish. The strong price growth was due to the fact that the global supply of herring has fallen by more than 30 percent from 2021, while demand has remained stable in key markets. Poland, Egypt and Lithuania were the largest markets for Norwegian herring. Although 2024 Norwegian exports of herring, at 227 916 tonnes, were down slightly from the 2023 figure, it was a record high year in terms of value (NOK 4.2 billion). A price increase of about 17 percent was seen for 14 herring products, particularly skinless frozen fillets and whole frozen fish. The strong price growth was due to the fact that the global supply of herring has fallen by more than 30 percent from 2021, while demand has remained stable in key markets. Poland, Egypt and Lithuania were the largest markets for Norwegian herring.

Source: Author’s own elaboration based on GTT. 2025. Global Trade Tracker. [Cited 1 January 2025]. www.globaltradetracker.com

Mackerel

As mentioned above, consensus has not been reached between the countries fishing on the mackerel resource; consequently, ICES estimates that catches of Atlantic mackerel (Scomber scombrus) in 2025 may end up exceeding 954 000 tonnes. If this fishing pressure is maintained, the stock will eventually fall below the biological limit (Blim). As mentioned above, consensus has not been reached between the countries fishing on the mackerel resource; consequently, ICES estimates that catches of Atlantic mackerel (Scomber scombrus) in 2025 may end up exceeding 954 000 tonnes. If this fishing pressure is maintained, the stock will eventually fall below the biological limit (Blim).

Horse mackerel (Trachurus trachurus) stocks in the North Sea and eastern English Channel are in even dire straits. In an ICES report in September 2024, the catch recommendation was zero due to stocks being at critically low levels. In Peru, horse mackerel landings dropped to 21 500 tonnes during the first half of 2024 from 53 300 tonnes during the same period of 2023, impacted by past recent El Niños and La Niña events.

Trade and Markets

Strong exports from Norway

Norway’s seafood exports reached NOK 44.1 billion (USD 4.1 billion) in the third quarter of 2024, an increase of five percent, or NOK 2.2 billion (USD 206 million), over the same period of 2023. After a negative first half of 2024, the increase was substantial enough to put Norway back into a net positive in value terms for the first three quarters of the year. The third quarter 2024 thus marked the best third quarter ever due to record high export values. In the whole of 2024, 313 242 tonnes of mackerel were exported, worth NOK 8.3 billion (USD 734 million), up by two percent in volume and 24 percent in value compared to the previous year. This was a new export record for mackerel, driven by an average price increase of 22 percent. Japan, China and the Republic of Korea were the largest markets for Norwegian mackerel in 2024.

About 130 000 to 140 000 tonnes of Norwegian mackerel is consumed in Japan annually. Meanwhile, innovative branding campaigns are seeing results; for example, in the autumn season (late September to early November), Jalux, a trading company of the Japan Airlines group, flies in Norwegian mackerels that weigh 500 grams or more and have a fat content of 30 percent. On 20 September 2024, the first consignment of the year was brought in, comprising approximately 2 000 kg of fresh Norwegian mackerel, and which was sold under the brand “Saba Nouveau.”

China has traditionally been a processing market for Norwegian mackerel, where the processing was previously contracted out to Japanese companies that were responsible for imports. However, in 2024, the Chinese companies themselves began to import and process Norwegian mackerel and then sell it on to the Japanese market. At the same time, demand in China for mackerel has continued to grow, causing companies to pay more attention to the domestic market instead of re-export.

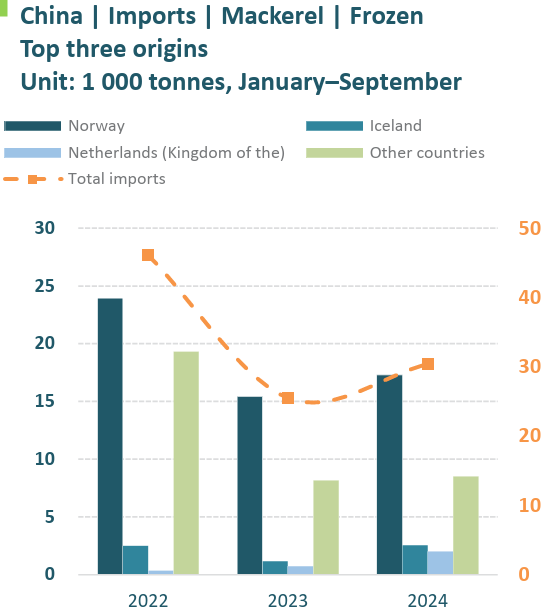

Asia: Frozen mackerel imports

A weakening trend was observed for the overall imports of frozen mackerel in Asia during January–September 2024, reflected by an almost 20 percent drop in comparison with the same period a year ago. Among the top 10 markets in the region, imports rose in Viet Nam (+4.5 percent), China (+20 percent) and Türkiye (+60 percent) as compared to the same period in 2023. Increased supplies from Norway were noted for Viet Nam (19 429 tonnes), China (17 200 tonnes) and Türkiye (6 181 tonnes) in January–September 2024. Smaller import volumes of Norwegian mackerel were recorded for Taiwan Province of China (6 515 tonnes), Singapore (691 tonnes) and Malaysia (644 tonnes). A weakening trend was observed for the overall imports of frozen mackerel in Asia during January–September 2024, reflected by an almost 20 percent drop in comparison with the same period a year ago. Among the top 10 markets in the region, imports rose in Viet Nam (+4.5 percent), China (+20 percent) and Türkiye (+60 percent) as compared to the same period in 2023. Increased supplies from Norway were noted for Viet Nam (19 429 tonnes), China (17 200 tonnes) and Türkiye (6 181 tonnes) in January–September 2024. Smaller import volumes of Norwegian mackerel were recorded for Taiwan Province of China (6 515 tonnes), Singapore (691 tonnes) and Malaysia (644 tonnes).

Source: Author’s own elaboration based on GTT. 2025. Global Trade Tracker. [Cited 1 January 2025]. www.globaltradetracker.com

Asia: Dried mackerel and other small pelagics

Strong demand for small pelagics in Southeast Asia’s fresh fish trade has significantly reduced the availability of Indian mackerel (Rastrelliger spp), scad and similar species for processing into dried product. This shortage has in turn, led to increased demand for, and utilization of, all types of small fishes (including those obtained from bycatches) to produce salted/dried food fish. Popular in Indonesia, Malaysia and Thailand, prices of this product group in the retail trade range from USD 10.00–15.00/kg.

Outlook

The likelihood that North-east Atlantic coastal States will work out an equitable quota-sharing arrangement for overfished stocks is very low at present, which means that stocks will continue to be overfished in the foreseeable future.

After ending on a high note in 2024, and beginning 2025 with export prices being almost NOK 10 (USD 0.88) per kg higher than at the beginning of 2024, the market for Norwegian mackerel is expected to remain strong in these next few months. Meanwhile, Asian demand for mackerel and other key commercial pelagic fish species, particularly in China, Viet Nam, and countries in Southeast Asia, will maintain an upward trend.

[email protected]

www.seafood.media

|