|

Photo: FAO-Globefish

FAO-Globefish - Seabass and Seabream Market Overview

WORLDWIDE WORLDWIDE

Monday, March 24, 2025, 03:00 (GMT + 9)

Stable markets in Europe with consistent demand and small supply shifts

During January–September 2024, global seabass and seabream markets showed stable demand with moderate rises in sales value. The continued expansion of Turkish exports underscores the ongoing opportunities in Europe, with Greece being the fastest-growing market.

Trade and markets

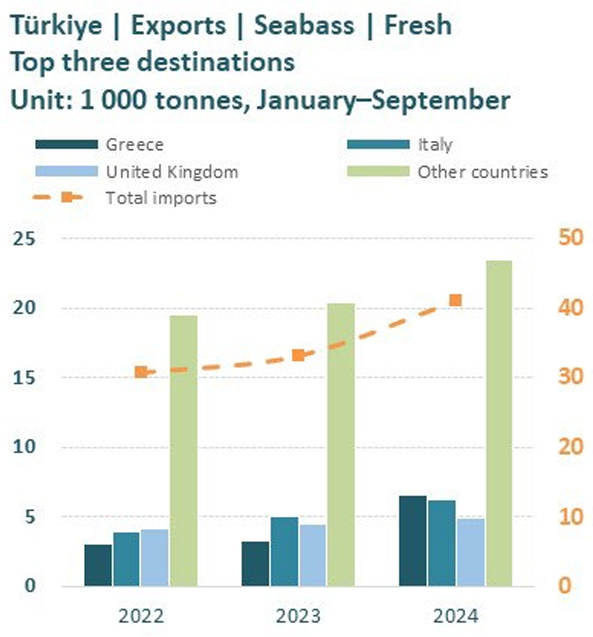

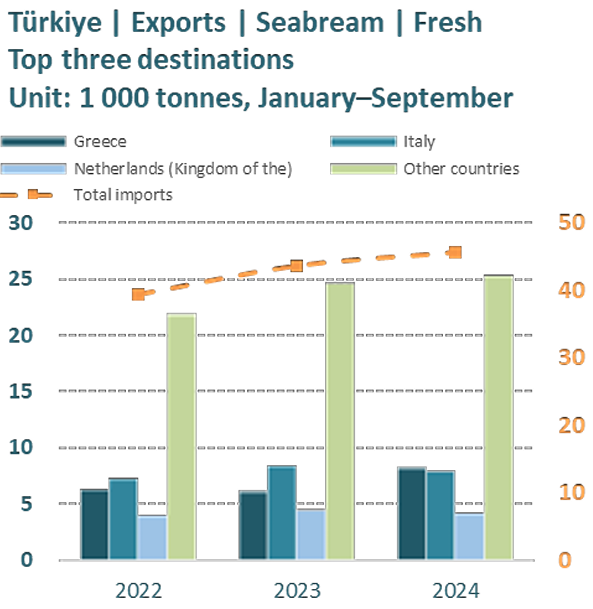

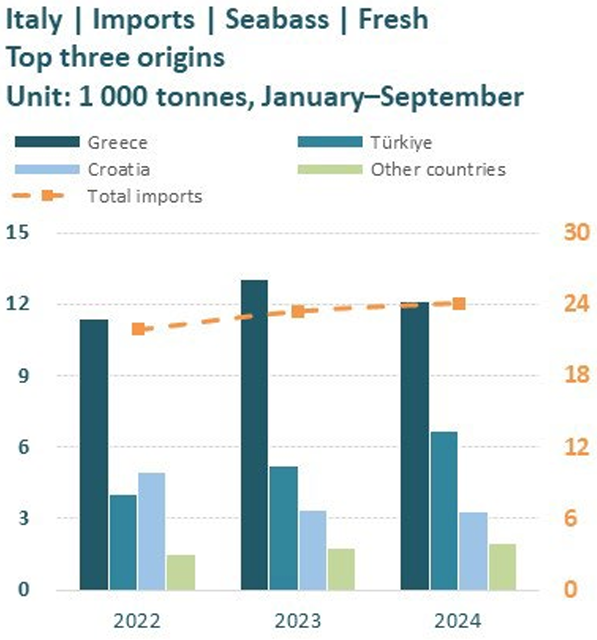

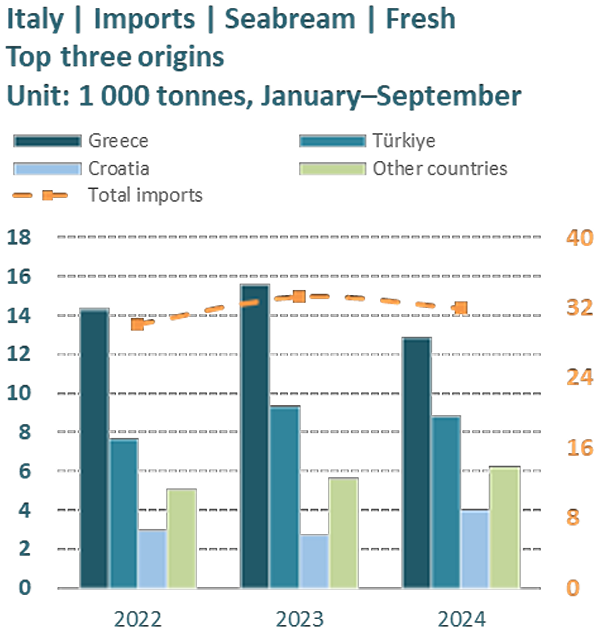

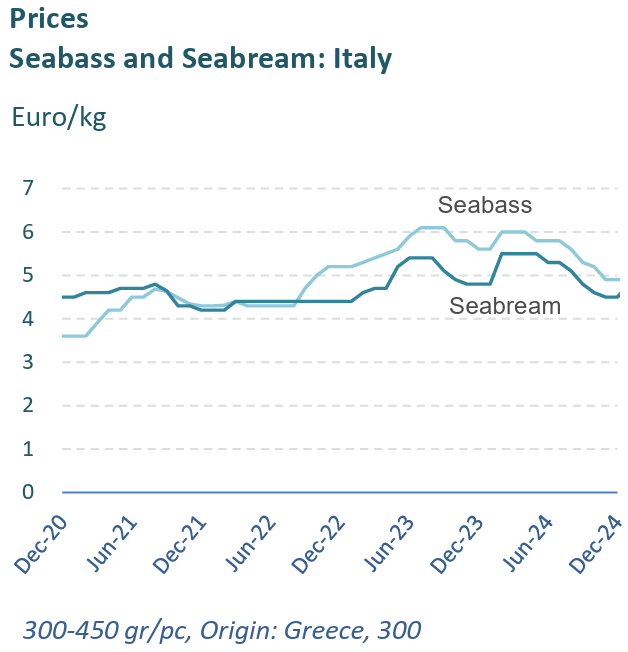

Türkiye’s seabass exports grew by 24 percent in volume but only 12 percent in value during the first nine months of 2024, while seabream exports increased by five percent in volume and 26 percent in value, year-on-year. Fluctuations of the Turkish lira against the Euro and the USD have influenced export revenues, with a weaker lira making Turkish seafood more competitive in foreign markets but reducing per-unit revenue in hard currency. Greece and Italy remained Türkiye’s largest destinations for seabass and seabream. Greece, in particular, emerged as the fastest-growing market in the period under review, with seabass trade value in USD surging by 81 percent and seabream by 65 percent year-on-year. In contrast, Italy experienced more moderate growth, with seabass trade value rising by 18 percent and seabream by 20 percent over the same period. This moderate growth in Italy suggests a stable market with consistent demand and minimal supply or price shocks. Türkiye’s seabass exports grew by 24 percent in volume but only 12 percent in value during the first nine months of 2024, while seabream exports increased by five percent in volume and 26 percent in value, year-on-year. Fluctuations of the Turkish lira against the Euro and the USD have influenced export revenues, with a weaker lira making Turkish seafood more competitive in foreign markets but reducing per-unit revenue in hard currency. Greece and Italy remained Türkiye’s largest destinations for seabass and seabream. Greece, in particular, emerged as the fastest-growing market in the period under review, with seabass trade value in USD surging by 81 percent and seabream by 65 percent year-on-year. In contrast, Italy experienced more moderate growth, with seabass trade value rising by 18 percent and seabream by 20 percent over the same period. This moderate growth in Italy suggests a stable market with consistent demand and minimal supply or price shocks.

Greece’s seabream export value remained stable despite a 13 percent decline in total export volume during the first nine months of 2024. In contrast, seabass exports showed growth in both volume and value, with an 18 percent increase in total export volume and a 17 percent year-on-year rise in export value. Italy remains a key market for seabass and seabream from Greece, maintaining stable trade during the period under review. This implies that Italian buyers did not face major supply disruptions or price volatility, thus supporting predictable trade flows. Seabass imports into Greece in January–September 2024 increased by three percent in both volume and value year-on-year, while seabream imports experienced a four percent decline in volume but a seven percent rise in USD value. Greece’s seabream export value remained stable despite a 13 percent decline in total export volume during the first nine months of 2024. In contrast, seabass exports showed growth in both volume and value, with an 18 percent increase in total export volume and a 17 percent year-on-year rise in export value. Italy remains a key market for seabass and seabream from Greece, maintaining stable trade during the period under review. This implies that Italian buyers did not face major supply disruptions or price volatility, thus supporting predictable trade flows. Seabass imports into Greece in January–September 2024 increased by three percent in both volume and value year-on-year, while seabream imports experienced a four percent decline in volume but a seven percent rise in USD value.

Asian seabass (Lates calcarifer)

Various studies have predicted significant market growth for Asian seabass. In one such study, the global market size for the species was valued at USD 45.92 million in 2024; furthermore, it forecasts a compound annual growth rate (CAGR) of 6.3 percent between 2023 and 2033, by which time the value of the global market will be approximately USD 8.2 billion. The big players in the industry are investing heavily in sustainable aquaculture practices, advanced fish feed technologies, disease prevention and treatment, as well as traceability verification.

The top producer of Asian seabass is Thailand, where the aquaculture sector benefits from extensive official support. In light of market challenges (including Malaysia’s tariff-free seabass exports under the ASEAN Free Trade Agreement), the Thai Chamber of Commerce and the Thai Restaurant Association are working together with the authorities to revitalize the domestic seabass market. To support farmers and generate market demand, stakeholders are prioritizing the promotion of safe, fresh and high-quality seabass.

Prices

In the Spanish seabream wholesale market, the price of fresh whole fish (300–400g) saw a significant increase in Q1 2024, followed by a steady trend during April–September2024. It then surged to a high of around EUR 6.7 per kg in November 2024, before dipping slightly to EUR 6.5 per kg in December 2024. Larger sizes (400–600g) followed a similar price pattern but experienced a sharp decline in November, dropping by 21 percent from a peak of EUR 17.8 per kg early in the month to EUR 14.0 per kg by the beginning of December. Since then, however, prices have recovered and remained above EUR 16.0 per kg. Meanwhile, prices for 600g seabream remained stable in the period under review before entering on an upward trajectory after September, and reaching a record high of EUR 8.1 per kg in December 2024.

Meanwhile, in the Spanish seabass market, prices for large, farmed fresh whole fish remained stable during the first nine months of 2024. However, the last quarter saw a significant decline compared to the previous period, with prices dipping in November to around EUR 11.24 per kg before rebounding to EUR 11.60 per kg in December 2024. Prices for medium-sized seabass exhibited a downward trend in the first nine months of 2024, but steadily increased after reaching a historical low of EUR 4.95 per kg in September, and then rising to EUR 7.3 per kg in December 2024. The price level for smallsized seabass fluctuated during the first nine months of 2024. In November it was recorded at EUR 5.5 per kg, which increased to EUR 5.85 per kg for a short period before stabilizing at the earlier level.

Outlook

A positive trajectory is expected for the European seabass and seabream markets, driven by consistent demand, strategic industry initiatives, and a growing emphasis on quality and sustainability. However, rising production costs and currency fluctuations present potential challenges. Despite these factors, continued investments in innovation, efficiency, and sustainability are expected to support steady growth and expanding opportunities worldwide. Sustainability certifications as well as a shift toward value-added products are likely to enhance market competitiveness. Moreover, expanding consumer bases in Asian countries and increasing imports in that region are expected to foster market growth.

[email protected]

www.seafood.media

|

|