|

Photo: FAO/FIS

Globefish report on the global squid market

WORLDWIDE WORLDWIDE

Thursday, July 18, 2024, 07:00 (GMT + 9)

The following is an excerpt from a report published by Globefish (FAO):

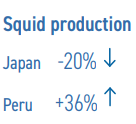

Japanese squid supplies fell by about 20 percent in 2023 compared to the previous year, to just 150,000 tonnes. Supplies from all sources (domestic landings, imports and inventory carry-over) went down.

According to Japan’s National Federation of Fisheries Co-operative Associations, the decline was mostly because of record-low domestic catches of Japanese flying squid. Landings fell by 23 percent in 2023 to a 60-year low of only 3,348 tonnes. Fresh Japanese flying squid, which is mainly used for sashimi, fell by 35 percent to just 1,550 tonnes in 2023; the lowest level since 1984. At the same time, landings of frozen Japanese flying squid dropped even more: down 60 percent to 1,780 tonnes. Consequently, exvessel prices for fresh flying squid jumped by 22 percent in 2023 and prices for frozen flying squid soared by 51 percent. According to Japan’s National Federation of Fisheries Co-operative Associations, the decline was mostly because of record-low domestic catches of Japanese flying squid. Landings fell by 23 percent in 2023 to a 60-year low of only 3,348 tonnes. Fresh Japanese flying squid, which is mainly used for sashimi, fell by 35 percent to just 1,550 tonnes in 2023; the lowest level since 1984. At the same time, landings of frozen Japanese flying squid dropped even more: down 60 percent to 1,780 tonnes. Consequently, exvessel prices for fresh flying squid jumped by 22 percent in 2023 and prices for frozen flying squid soared by 51 percent.

Peru had a record-breaking year for squid in 2023. Landings rose by 36 percent to 621,852 tonnes, up from 457,364 tonnes in 2022. As much as 92.5 percent of the catch was channeled into the manufacturing of frozen products, while 7.5 percent went in fresh form to the domestic market. The production of frozen squid products for export markets rose by almost 65 percent to 453,100 tonnes. Thus, squid is now the second most important fishery in Peru, after anchovy Peru had a record-breaking year for squid in 2023. Landings rose by 36 percent to 621,852 tonnes, up from 457,364 tonnes in 2022. As much as 92.5 percent of the catch was channeled into the manufacturing of frozen products, while 7.5 percent went in fresh form to the domestic market. The production of frozen squid products for export markets rose by almost 65 percent to 453,100 tonnes. Thus, squid is now the second most important fishery in Peru, after anchovy

Chinese overseas fishing fleet targeting squid in South America

For a number of years, foreign vessels, primarily Asian (mostly Chinese), have been fishing for squid just outside the Argentine Exclusive Economic Zone (EEZ). Some environmentalists have now voiced their concern about this activity, which they claim could pose a serious threat to the resource.

About 600 foreign vessels are operating in these waters, and about 400 of them are Chinese, while the remaining 200 are from various other Asian destinations (the Republic of Korea and Taiwan Province of China) and Spain. One of the main problems with this kind of fishing is that it is largely unregulated and therefore poses huge international regulatory challenges. There is no Regional Fisheries Management Organization (RFMO) existing in the area, that could regulate this fishing effort.

A total of 615 large vessels, 95% from China, were detected fishing for giant squid in the Southeast Pacific Ocean in 2020. Photo: GFW

The Chinese overseas fleet, which numbers about 1,600 vessels fishing in international waters all over the world, is a result of the country’s goal to increase fisheries production. In 2012, the Chinese Overseas Fisheries Association (COFA) was formed as a tool to develop Chinese overseas fishing operations. China’s catch in distant waters is estimated to be about 1.15 million tonnes, worth about USD 1.98 billion annually. The squid industry is certainly an important part of China’s overseas fishing industry. Chinese squid catches grew from 75,500 tonnes in 1998 to nearly 1.1 million tonnes in 2022.

Trade

Argentina was off to a good start in 2024: its seafood exports in January rose by 25 percent compared to January 2023, and squid was an important part of this growth. In that month, Argentina exported 2 183 tonnes of squid worth USD 5.3 million, up by 143 percent in volume and 194 percent in value compared to January 2023. Prices were noticeably higher than the previous year. The main markets were Spain, China and Brazil.

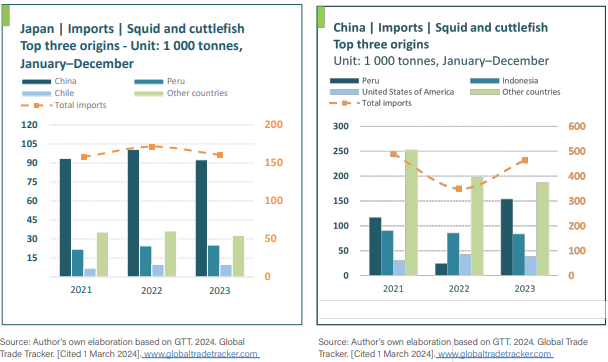

Click image to enlarge it

Spanish imports fell by a modest 2.4 percent to 283,383 tonnes in 2023, as compared to 290,339 tonnes in 2022. The largest supplier, the Falkland Islands (Malvinas), saw a reduction of 9.2 percent, while the second and third biggest suppliers, Peru and Morocco, registered increases of 22.7 and 32.1 percent, respectively.

Chinese imports of squid and cuttlefish, on the other hand, increased by a healthy 32.7 percent. Peru increased its supplies to China by an incredible 532 percent to 154,262 tonnes, thus accounting for over one-third of the total.

Click image to enlarge it

Meanwhile, Chinese exports of squid and cuttlefish fell by 12.4 percent in 2023 to 507,905 tonnes. Practically all markets registered a fall in imports from China: Japan was down by 8.1 percent to 99,719 tonnes; Thailand -17.2 percent to 67,311 tonnes; the Republic of Korea -1 percent to 62,205 tonnes; the United States -20 percent; the Philippines -21.7 percent; and Malaysia -25.3 percent.

.png) Squid and cuttlefish imports into the Republic of Korea increased by 10 percent in 2023 to 169,843 tonnes. The largest suppliers were China (60,909 tonnes or 36 percent of the total); Peru (58,804 tonnes or 35 percent of the total); and Chile (18,837 tonnes or 11 percent of the total). Squid and cuttlefish imports into the Republic of Korea increased by 10 percent in 2023 to 169,843 tonnes. The largest suppliers were China (60,909 tonnes or 36 percent of the total); Peru (58,804 tonnes or 35 percent of the total); and Chile (18,837 tonnes or 11 percent of the total).

Outlook

Supplies of octopus are expected to continue to be tight through 2024; consequently, prices will remain high. Furthermore, during the summer holidays, prices are expected to go up even more as a result of higher demand from tourists, especially in the Mediterranean region.

Supplies of squid may be better, as the fishing in several regions was off to a good start. Squid prices are expected to decline somewhat.

Although international trade weakened a little during 2023, the squid trade could pick up again, provided the expectation of better landings becomes a reality.

Source: FOA-Globefish

[email protected]

www.seafood.media

|