|

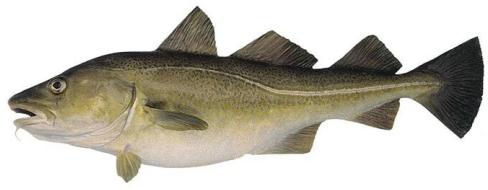

Image: Norwegian Seafood Council / FIS

Market situation for Norwegian cod (fresh, frozen, salted, dried, clipfish)

(NORWAY, 5/8/2023)

(NORWAY, 5/8/2023)

Value growth and volume decline for fresh cod

Photo: Stockfile FIS

- Norway exported 6,993 tonnes of fresh cod worth NOK 385 million (USD 36.43 M) in April

- Export value increased by NOK 30 million (USD 2.84 M), or 8 per cent, compared to April last year

- Export volume fell by 8 per cent

- Denmark, the Netherlands, and Spain were the biggest markets for fresh cod in April

Landings of fresh cod were also significantly lower in April than in the same month the previous year, which has resulted in a lower export volume.

Growth to Spain

“There was solid volume growth to Spain in April, and we must go back to 2018 to find a higher export volume of fresh cod to Spain in the month of April. Spain is also the market with the largest increase in value this month, with an increase in export value of NOK 22 million, or 131 per cent, compared to the same month last year”, says Eivind Hestvik Brækkan, Seafood Analyst with the Norwegian Seafood Council.

.jpeg)

The export volume to Spain ended at 671 tonnes, which is 86 per cent higher than the same month last year.

Good season for the quality brand Skrei

- Norway exported 682 tonnes of skrei worth NOK 39 million (USD 3.69 M) in April

- The value of exports increased by NOK 6 million (USD 570 K), or 17 per cent, compared to April last year.

- There is a growth in export volume of 4 per cent.

- Denmark, Spain, and Germany were the biggest markets for skrei in April.

The end of the skrei season resulted in volume growth for the quality brand skrei, even with a decrease in landings.

“The quality-marked skrei is spawn-ready skrei that has been selected, processed, and packed according to specific requirements described in a separate quality standard. Only skrei that meet the requirements of the standard can be sold with the quality mark for skrei, and one of the requirements is that it must have been caught in the period 1 January to 30 April”, says Eivind Hestvik Brækkan, Seafood Analyst with the Norwegian Seafood Council.

.jpg)

Photo: Stockfile FIS

Increased proportion of skrei despite lower landings

In total, this year's fishing season ended with an export volume of 4,212 tonnes, a decrease of 6 per cent from last year. The export value was a total of NOK 282 million (USD 26.69 M), NOK 43 million (USD 4.07 M) higher than last year.

“18 per cent of Norway's exports of fresh whole wild-caught cod were quality-marked skrei in this year's season. This is 2 percentage points higher than last year. It is also worth noting that skrei´s share is increasing even though both landings and exports of fresh whole wild-caught cod are falling”, says Brækkan.

.jpg)

Price difference of NOK 14 (USD 1.32) per kg

The price is also increasing, helped by the weaker Norwegian krone.

“Never before has the export price been over NOK 60 (USD 5.68) per kg in one season, and this year it ended at NOK 67 (USD 6.34) per kg, a whole NOK 13 (USD 1.23) per kg higher than last year. The price difference between the quality brand skrei and other fresh whole wild cod has also hit record highs, with a hefty NOK 14 (USD 1.32) per kg premium for skrei this year”, explains Eivind Hestvik Brækkan.

Growth in exports to Spain

Most of the quality-marked skrei is exported to Denmark before it goes on to the large skrei markets in Europe. A significant share also goes directly to Spain, which is our largest consumer market.

For the entire ice cream season, the export volume to Spain ended at 1,168 tonnes. This is an increase of 30 per cent, up from 900 tonnes last year. Only in two other years has the direct export of skrei to Spain been higher, and then this year with significantly higher quotas.

Solid demand

“The skrei has really established itself as a very special fish both among consumers and for trade buyers in Spain. Demand has been solid this year, and if it hadn't been for bad weather and low supply at the start of the year, it would have been the best-ever export season to the Spanish market. The strong position is confirmed by the fact that significantly more shops are selling skrei this year”, says Bjørn-Erik Stabell, the Norwegian Seafood Council's envoy to Spain.

Volume drops for frozen cod

- Norway exported 5,456 tonnes of frozen cod worth NOK 323 million (USD 30.57 M) in April

- The value was unchanged from the same month last year

- The volume fell by 14 per cent

- The UK, France and Portugal were the biggest markets for frozen cod in April

Like fresh cod, there was also a decrease in landings of frozen cod in April. This results in a lower export volume.

Good start to the year

“The export volume to Great Britain continues to increase and ended at 1,275 tonnes in April, an increase of 28 per cent from April last year. Frozen whole cod contributed most to the increase, but frozen fillets also increased somewhat in volume. We have to go back to 2019 to find a higher export volume of frozen cod to the UK after the first four months of the year”, says Eivind Hestvik Brækkan, seafood product analyst at the Norwegian Seafood Council.

Greatest increase in value to France

France had the greatest increase in value in April, with an increase in export value of NOK 32 million (USD 3.03 M), or 155 per cent, compared to the same month last year.

The export volume to France ended at 380 tonnes, which is 92 per cent higher than the same month last year. Most of the exports to France were frozen fillets.

Challenging month for clip fish

.png)

Photo: Stockfile FIS

- Norway exported 4,481 tonnes of clip fish to a value of NOK 316 million (USD 29.90 M) in April

- Export value fell by NOK 7 million (USD 660 K), or 2 per cent, compared to April last year

- Export volume fell by 24 per cent

- Portugal, the Dominican Republic, and Congo-Brazzaville were the biggest markets for clip fish in April

The export volume of both haddock and cod fell in April, by 32 and 12 per cent respectively, or 1,150 and 200 tonnes.

For clip fish, the Dominican Republic, Congo-Brazzaville, and Brazil were the biggest markets.

Strong growth in the Dominican Republic

“The Dominican Republic excels with growth in export volume in April as well. So far this year, the growth is a whopping 65 per cent compared to last year. Jamaica and Congo-Brazzaville are the countries with the biggest decline in the export volume of clip fish of pollock in April", says Eivind Hestvik Brækkan, Seafood Analyst with the Norwegian Seafood Council.

.png)

Increase of 26 per cent to Portugal

Portugal is, as usual, the largest market for cod clip fish, and around 60 per cent of the cod clip fish went to Portugal in April.

“Portugal is also the country with the largest increase in value for clip fish this month, with an increase in export value of NOK 28 million (USD 2.65 M), or 26 per cent, compared to the same month last year”, says Brækkan.

Decrease in home consumption

The export volume to Portugal ended at 1,227 tonnes, which is 2 per cent higher than the same month last year.

“Increased exports in April means that the export volume so far this year is now 8 per cent lower than at the same time last year. We also see a decline in home consumption of cuttlefish in Portugal in the first quarter. A small bright spot is increased tourism, and in March there were more overnight guests than in the same month in 2022 and in 2019”, says Trond Rismo, the Norwegian Seafood Council's envoy to Portugal.

Sky-high food inflation

In the first quarter, Portugal was also one of the countries with the highest economic growth in Europe.

“However, food inflation is still sky high, and the figures for April show a price increase of almost 20 per cent for food over the past year. The expectations going forward are that economic growth will be relatively weak”, explains Rismo.

Record month for salted fish

.png)

Photo: Stockfile FIS

- Norway exported 4,256 tonnes of salted fish to a value of NOK 377 million (USD 35.68 M) in April

- Export value increased by NOK 44 million (USD 4.16 M), or 13 per cent, compared to April last year

- Export volume fell by 13 per cent

- Portugal, Spain, and Italy were the biggest markets for salted fish in April

This is a record high export value for salted fish in a single month, NOK 9 million (USD 850 K) higher than the previous record month, which was in March 2007.

Portugal bought almost all Norwegian salted fish

“Low landings especially in January and February contributed to low export volumes in the first quarter. While the volume also fell in April compared to last year, it is higher than in April two years ago. Measured in terms of value, over 90 per cent of the salted fish in April went to Portugal”, says Eivind Hestvik Brækkan, Seafood Analyst with the Norwegian Seafood Council.

Portugal was also the country with the largest increase in value this month, with an increase in export value of NOK 42 million (USD 3.97 M), or 14 per cent, compared to the same month last year.

The export volume to Portugal in April ended at 3,807 tonnes, which is 12 per cent lower than the same month last year.

Growth for dried fish

.jpg) Norway exported 238 tonnes of dried fish to a value of NOK 60 million (USD 5.68 M) in April Norway exported 238 tonnes of dried fish to a value of NOK 60 million (USD 5.68 M) in April- Export value increased by NOK 28 million (USD 2.65 M), or 90 per cent, compared to April last year

- Export volume grew by 43 per cent

- Italy, the USA, and Nigeria were the biggest markets for dried fish in April

Photo: Stockfile FIS-->

Italy had the greatest increase in value in April, with an increase in export value of NOK 14 million , or 62 per cent, compared to the same month last year.

The export volume to Italy ended at 122 tonnes, which is 13 per cent higher than the same month last year.

Better economy in Italy

“With the increase in April, the export volume for dried fish to Italy so far this year is at the same level as last year. In Italy, households' expectations for their own finances have improved somewhat recently, and economic growth in the first quarter of this year was somewhat higher than the average for the EU. Inflation is somewhat lower than it was at its peak last year, and a further decline is expected over the course of the year”, says Eivind Hestvik Brækkan, seafood product analyst at the Norwegian Seafood Council.

Source: Norwegian Seafood Council

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

Stortorget 1 - P.O.Box 6176

|

|

City:

|

Tromsø

|

|

State/ZIP:

|

(N-9291)

|

|

Country:

|

Norway

|

|

Phone:

|

+47 776 033 33

|

|

Fax:

|

+47 776 800 12

|

|

E-Mail:

|

[email protected]

|

|

Skype:

|

https://www.instagram.com/norges_sjomatrad/

|

More about:

|

|

|

|