|

Image: Revista Puerto / FIS

Fishery exports in the first half

(ARGENTINA, 7/25/2023)

(ARGENTINA, 7/25/2023)

The report prepared by CAPECA shows a similar level of sales to the same period last year, but in the analysis by species, a retraction is observed in the demand for whole shrimp and squid. There was also an increase in shrimp tails and hake filet, but with a drop in prices.

CAPECA's export report for the first half of 2023 gives an overview of the behavior of the market this year. Hake fillet shows an increase in demand, but its main market has required fewer products; Hake in other presentations is one of the few species that shows an increase in the volume of veins and prices. Whole shrimp remains on the downward curve, while for tails the number of tons sold increases, although the price continues to fall. In squid, a drop in exports is observed, as a result of the scarcity of resources and a decrease in demand. Patagonian toothfish and king crab, for their part, maintain a high level of sales and prices with a predominant buyer, the United States. At this time, the sector awaits the announcement of new economic measures from the government, which in principle would contemplate an update of the fishing dollar, with which they seek to slightly balance the imbalance imposed by the exchange rate in the economy of companies.

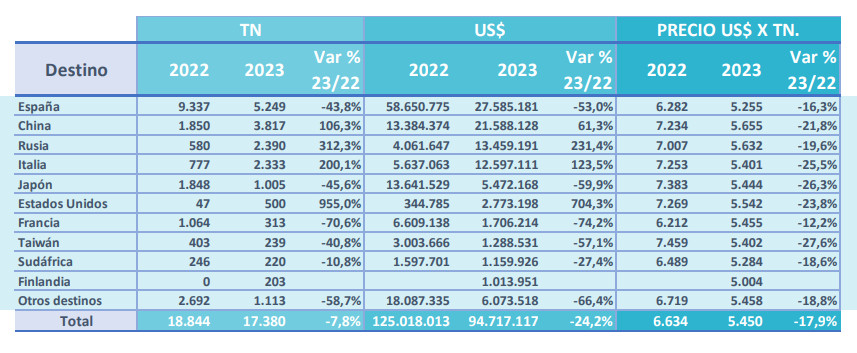

Total exports by destination. Source: Capeca

The total exported in the first semester exceeded 200 thousand tons for a value of 824 million dollars. In volume, squid has been the main product and shrimp tails in foreign currency. Compared to the same period in 2022, exports remain stable, although they have dropped a few points compared to 2021.

Hubbsi hake

In the analysis by product, it is observed that hubbsi hake fillets continue to increase their sales volume: in this period, a growth of 5% is registered with 28 thousand tons exported. But this increase is not linearly accompanied by the income of foreign exchange, which experienced a rise of 4.2% because the average price of the filet fell by 0.9%, settling at 3,225 dollars per ton. In total, 28,436 tons were exported for 91.7 million dollars.

(3).png)

Source: Stockfile FIS

The best price was paid by Israel, at $3,523 per ton, but it is also the country that reduced demand the most, less than half that of last year. The main market is still Brazil, but the demand continues to drop; In this first semester they have bought 17% less than in 2022 and 21% less was collected because the price fell 5.4% for this market. The good news was provided by Spain, which increased demand by 110%, requiring volumes almost as high as those of Brazil, although at a lower price, even below the average, at $3,086 per ton. The other two markets that follow in importance, the United States and Poland, have considerably reduced demand.

The presentations of frozen hake in which the filet is excluded improved sales a little, with 15,745 tons they had a growth of 2.5% and with the price increase of 2% they achieved a 4.7% higher collection. The main buyer was Russia, followed by Jordan, Ukraine, Israel and South Africa. The average price was located at 1,532 dollars per ton; the highest price (1,880 dollars) was paid by the United States and South Africa is the one that paid the least, at a rate of 1,186 dollars per ton.

Whole shrimp

The whole shrimp fails to recover, either due to excess supply; change in consumption habits or fierce competition from vannamei, the truth is that the demand continues to drop and the price to fall. In volume this semester, 8% less than in 2022 has been exported and also at a price 18% lower, which has reduced the income of foreign currency by 24% compared to the same period last year. In total, 17,380 tons were sold for $94.7 million.

.jpg) Source: Stockfile FIS --> Source: Stockfile FIS -->

The average price stood at $5,450, but as if that wasn't low enough, there were markets that paid even less. This is precisely the case of its main buyer, Spain, which demanded 43.8% less and for a value 16.3% lower than last year; from 9 thousand tons he went on to buy 5 thousand and from 6,282 dollars a ton he went on to pay 5,255 dollars. While in 2022 only 58 million dollars entered from Spain for the sale of whole shrimp, this year it was 27 million.

China has activated purchases a bit, but has not been able to replace what the fall in the Spanish market implies. Demand increased 106% but represents 3,800 tons that were sold at a price 22% lower than in 2022, trading at $5,655 per ton. Russia bought at a similar price, which in the current context surprises with an increase in demand of 312%, which represents 2,390 tons.

With a 25.5% lower price, Italy bought again, after a 2022 in which demand collapsed. This year they bought 200% more, which represents about 2,300 tons, but it is still below the purchase volumes of 2021. This occurs despite the fact that the price was below the average value, at $5,401. The Japanese market seems to be worse than with a drop in the price of the same level as Italy, buying 46% less than last year. The French market also drastically reduced its purchases.

Shrimp tails

.png) <-- Source: Stockfile FIS <-- Source: Stockfile FIS

Shrimp tails present a completely different picture in terms of sales volume: they grew by 86%, exporting 40,000 tons, but at a 5.5% lower price, standing at $7,493 per ton. The foreign exchange income was 303.3 million dollars, which represents an increase of 75.7% compared to the first half of last year.

The largest buyer was China, which acquired 13,000 tons, which represents an important reactivation of this market, which last year bought only 2,500 tons; although it was the one that paid the least, at a rate of 7 thousand dollars per ton. Spain, with 5,600 tons, was the second most important buyer, increasing the volume of demand by 55% and, although the price was lower than last year (5%), it stood at $7,848, being one of the countries that paid the best. Although the great difference in price is the United States brand: this market, which dropped demand by 22%, bought a ton at $11,432, a difference that is surely explained by the type of final product exported.

Thailand this year improved demand by 146%, reaching volumes similar to those of Spain, but with a significantly lower price of $7,129 per ton. Peru, another destination country for processing, maintained the level of purchases of recent years, close to 4,000 tons with a price of $7,104 per ton, below the average price.

Illex squid

.jpg) Source: Stockfile FIS --> Source: Stockfile FIS -->

75,358 tons were exported, 34.7% less than in 2022 at a 2% higher price, in the order of $2,172 per ton. This drop in demand is not only due to the availability of the resource in a season of low abundance, but also to a contraction in the market.

The main buyer has been South Korea with 18,000 tons, but it has required 37% less than last year and with a price below the average, trading at $2,028 per ton. China, the second most important buyer, required 17% less illex than last year and although the value was below the average price, it increased by 5% compared to 2022, reaching $2,015 per ton.

The large drop in demand occurs in several major markets. Thailand fell 63%, going from buying 21,000 tons to 8,000, at a price 3.6% higher than last year. In Singapore, on the other hand, the price fell one point, settling at $1,968 per ton, but this did not improve sales: on the contrary, they fell by 41%. Finally, Spain, which paid 6.6% more for illex with the most expensive price on the market, at $3,322 per ton, bought 53% less than in 2022, requiring only 3,280 tons.

Patagonian toothfish and king crab

For the dinosaur of the seas, sales are good, they increased by 7% in volume and although the price fell by 1.8%, it continues to maintain high values, trading at $25,067 per ton. The main buyer is still the United States, which with 763 tons absorbs 63% of total exports and at a price of $25,405 per ton.

.jpg)

Source: Stockfile FIS

King crab sales have improved by 10.6% in volume and have had a price increase of 14% compared to last year. 807 tons were sold to the United States; this is its only market and it pays $21,069 per ton.

Source: Revista Puerto

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

Adolfo Alsina 292 Piso 7º oficina A –

|

|

City:

|

C.A.B.A.

|

|

State/ZIP:

|

Capital Federal (C1087AAB)

|

|

Country:

|

Argentina

|

|

Phone:

|

+54 11 5218-8870

|

|

Fax:

|

+54 11 1325 5275

|

|

E-Mail:

|

[email protected]

|

|

Skype:

|

https://www.instagram.com/capecaok/

|

More about:

|

|

|

|