|

Image: Revista Puerto / FIS

Slight rise in fish exports

(ARGENTINA, 6/30/2023)

(ARGENTINA, 6/30/2023)

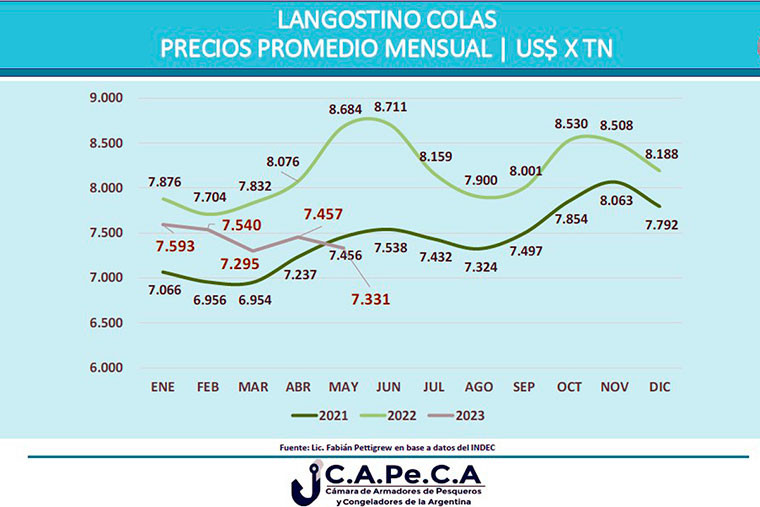

Hubbsi hake has been contributing positively; the squid sells its entire catch, but the scarcity gives negative numbers. Shrimp tails make the difference, although they grow in sales volume while the price falls. The whole shrimp continues with a low demand and despite the fact that the price is very low, it is increasing.

The monthly export report of the Chamber of Argentine Freezer Fishing Shipowners (CAPECA) for the month of May reflects the situation of foreign sales of the main products of the Argentine Sea and its relevance in the national context. An increase of 3.4% is presented as auspicious data when exports of primary products fell by 41.4% and manufactures of agricultural origin did so by 23.7%, during the months of January to May 2023 in comparison with last year. Total exports of primary and manufactured products totaled 16,361 million dollars, with the fishing sector representing 4.3%.

Source: Revista Puerto

From January to May, 170,664 tons were exported for a value of 697 million dollars, with shrimp tails being the product with the greatest impact; followed by the squid and the hake fillets. The main destination was the Asian continent, which represents 45%, followed by Europe with 22% and behind North America with 10% and South America with 9% of the total exported in dollars.

The main products

Hubbsi hake

(2).png)

Source: Stockfile FIS

As we said, the hake filet plays a leading role in increasing exports. More than 22 thousand tons have been exported, which represents a growth in demand of 8.6% and in foreign currency income the increase was 9.2%, reporting 73 million dollars. The difference is given by a slight increase in the price in the order of 0.6% in the interannual comparison, the average value is $3,238 per ton.

Although the main export destination is Brazil, the demand in this market fell by 3.5% and even the price fell by 3.2%, so the drop in foreign currency income is greater than that of volume, standing almost 7% below the same period last year. Spain, on the other hand, the second most important market, increased its demand by 78% and paid 7.2% more, generating an increase in foreign currency income of 91%. In any case, Brazil pays a price above the average and Spain below.

Source: CAPECA

Despite the low price paid by Spain, its increase in demand has made it possible to mitigate the impact of the drop in demand in the United States (-15%) and Poland (-45%), which are the third and fourth most important markets for this product.

The other frozen hake products that do not include the filet also had an increase in demand and in price. 11,700 tons were exported, which represented an increase in demand of 4.3% and foreign currency income increased by 7% because the average price increased by 2.7%, reaching 1,538 dollars per ton.

Whole Shrimp

.jpg)

Photo: Stockfile FIS

The whole shrimp, generally frozen on board, has been losing prominence in official statistics. In the period analyzed, the drop in demand is 18% and in foreign currency 32% because the price fell by 17% compared to last year. 12 thousand tons have been exported for 66 million dollars, with an average price of 5,380 dollars, according to the data from the report.

Spain, its main market, has reduced demand by 56% even when purchases have been made at a value 17% lower than in 2022, going from 8,000 tons to 3,500 tons. The combination of these two elements results in a 63% drop in collection in the Spanish market.

Source: CAPECA

China, which had been buying little or nothing, with 2,800 tons had an increase in demand of 274% but paid at a value 20% lower than last year. Despite this, it continues to be the destination with the best price, above the average price, reaching almost $5,600 per ton.

The values of the whole shrimp are very low compared to those who used to have this premium product. Without going back to its golden days, just looking at the prices of 2021 when it reached $7,680 a ton, the difference is very important. But although it may not seem like it, a rebound is beginning to take shape, given that in January of this year it hit its lowest floor with an average price of $5,291 per ton.

Other markets that began to demand are Russia and Italy, but the rest of the markets have lowered their demand. Japan and France stand out, as they have been important buyers of frozen shrimp on board.

Shrimp tails

.jpg) Source: Stockfile FIS --> Source: Stockfile FIS -->

For the tails the film is another, although sustained based on volume. 37 thousand tons have been exported for a value of 275 million dollars, which represents a 77% increase in demand and a 67% increase in foreign currency income due to the drop in price. This 10% difference is not reflected in the fall in the average price indicated in the report, which was assigned 6% in the year-on-year comparison. The explanation is found in the only market, the United States, in which the price rose by 12.3% but unfortunately the demand fell by 33% compared to last year. The average value was located at 7,455 dollars.

The main destination was China: with a 376% increase in demand, it acquired 12,000 tons that it paid at $6,985 per ton, a price 6% lower and below the average price. Spain, which ranks second in importance, increased its demand by 58% but here the price also fell by 4%. Thailand, another of the reprocessing destinations and the third most important market, increased demand by 143% and paid it 4.5% lower than in 2022.

Source: CAPECA

Illex squid

.jpg) <-- Photo: Stockfile FIS <-- Photo: Stockfile FIS

The squid, which had a season of low abundance and which will not be able to be replenished despite the summer that the jig fleet is experiencing at the end of the season, had negative sales figures due to the shortage. Sales fell 23% and the price only rose 1.7%, settling at $2,150 a ton.

There was a drop in sales in all its markets, but we cannot speak of a drop in demand, since this reduction is due to the lack of product. By May 2022, 89 thousand tons had been exported; this year for that date they had not even been caught: according to official data up to May 31 there were 85 thousand tons.

Source: CAPECA

The main market was South Korea, which bought 18,000 tons and paid a value 1% higher. It is closely followed by China, which required 14,000 tons and paid 4% more than last year. Singapore and Japan are the only markets in which the price has fallen and in Spain the illex was paid 12% more expensive this year.

Toothfish and King Crab

.jpg)

Sales of toothfish picked up and with demand from the United States it has been able to increase the volume exported by 42%, but it had a slight drop in price of 1%, reaching $25,525 per ton. The king crab, on the other hand, had a 5% drop in sales but its price increased by 14%, reaching $21,136 per ton; The United States is also the main buyer of this product.

Source: CAPECA

Source: Revista Puerto

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

Adolfo Alsina 292 Piso 7º oficina A –

|

|

City:

|

C.A.B.A.

|

|

State/ZIP:

|

Capital Federal (C1087AAB)

|

|

Country:

|

Argentina

|

|

Phone:

|

+54 11 5218-8870

|

|

Fax:

|

+54 11 1325 5275

|

|

E-Mail:

|

[email protected]

|

|

Skype:

|

https://www.instagram.com/capecaok/

|

More about:

|

|

|

|