|

Photo: VASEP/FIS

US Tariff Pressure Casts Shadow Over Vietnam's Seafood Exports, Slowing Growth in June

(VIET NAM, 7/4/2025)

(VIET NAM, 7/4/2025)

After a strong start to the year, Vietnam's seafood exports saw significantly dampened growth in June, primarily due to businesses proactively reducing shipments to the United States ahead of new reciprocal tariffs. The outlook for the second half of 2025 remains uncertain, heavily reliant on the severity of upcoming US trade policies.

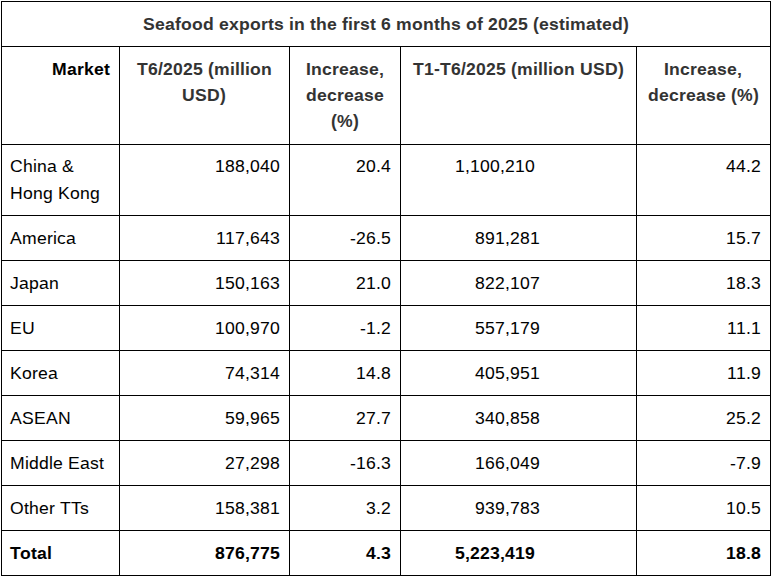

HANOI – Vietnam's seafood export sector, a crucial pillar of its economy, experienced a noticeable slowdown in June 2025. While still registering a 4% increase year-on-year to $876 million USD, this marks a sharp decline from the robust over 20% growth seen in May. The primary culprit appears to be the United States market, which saw a 26% decrease in exports compared to June last year.

.png) For the first six months of 2025, total seafood exports reached $5.2 billion USD, up nearly 19% year-on-year. Exports to the US, despite the June slowdown, still managed a 16% increase, totaling $891 million USD. This was largely attributed to an "acceleration" of deliveries by Vietnamese businesses keen to get products into the US before July 9th, the date new reciprocal tariffs were set to be applied. For the first six months of 2025, total seafood exports reached $5.2 billion USD, up nearly 19% year-on-year. Exports to the US, despite the June slowdown, still managed a 16% increase, totaling $891 million USD. This was largely attributed to an "acceleration" of deliveries by Vietnamese businesses keen to get products into the US before July 9th, the date new reciprocal tariffs were set to be applied.

However, as Ms. Le Hang, Deputy Secretary General of the Vietnam Association of Seafood Exporters and Producers (VASEP), revealed, "Since June, many businesses have proactively stopped exporting to the US to avoid the risk of being taxed heavily." This proactive measure reflects deep concerns within the industry regarding the impending trade measures.

Diversified Markets Offer Some Buffer, Tuna Takes a Hit

While the US market faltered in June, other key markets continued to show positive momentum. Exports to China, Japan, South Korea, and ASEAN nations maintained strong growth, increasing between 15% and nearly 28%. In contrast, exports to the European Union stagnated, recording a slight 1% decrease, while the Middle East region saw a sharp 16% drop, largely due to ongoing conflict, with exports to Israel (a major consumer of canned tuna) plummeting by over 50%.

Source: VASEP

In terms of product categories, tuna was the hardest hit in June, experiencing a sharp decline of over 31% compared to the same period last year. This drastic drop is directly linked to the impact of US tariffs on what is a major market for Vietnamese tuna. For the first six months of the year, tuna exports were down by nearly 2%.

Growth in shrimp and pangasius (tra fish), two of Vietnam's most significant seafood exports, also decelerated in June, similarly affected by the US tax policy. By the end of June, shrimp exports reached $2.07 billion USD (up 26%), and pangasius exports hit $1 billion USD (up 10%).

Uncertain Outlook for H2 2025

The trajectory for these two vital industries in the second half of 2025 hinges entirely on the US's reciprocal tax policy. The shrimp industry, in particular, faces the daunting prospect of "tax on tax," potentially encountering reciprocal duties alongside existing anti-dumping and anti-subsidy taxes.

For the pangasius industry, the outlook is somewhat more optimistic. The US Department of Commerce (DOC) recently announced the final results of its POR20 review, granting seven Vietnamese enterprises a 0% anti-dumping tax rate. This positive development could provide a crucial advantage if the upcoming reciprocal tax rate is manageable, potentially allowing Vietnamese pangasius to achieve a breakthrough in the US market.

VASEP's Forecast Scenarios for Year-End Exports:

VASEP has outlined two possible scenarios for Vietnam's total seafood export turnover in 2025, depending on the US reciprocal tariff rates:

-

Scenario 1: US reciprocal tax at 10% after July 9th. In this case, total export turnover for 2025 may decrease to approximately $9.5 billion USD, which is $500 million USD lower than VASEP's previous forecast. Other markets like China, ASEAN, Japan, and the EU might absorb some of the goods diverted from the US.

-

Scenario 2: Reciprocal tax exceeds 10%, potentially reaching 46%. This worst-case scenario could see exports plummet sharply to $9 billion USD or less. Under such conditions, the US would no longer be a stable market, especially for products with complex supply chains. Competition from countries with lower tariffs, such as Ecuador, India, Thailand, and Indonesia, would intensify significantly. Opportunities would shift towards "neutral" markets like Japan, the EU, and ASEAN, but their capacity to compensate for a substantial loss in the US market would be limited, particularly given the weak recovery of global consumer demand.

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

218 Road No.6, Zone A, An Phu An Khanh New Urban Area, District 2

|

|

City:

|

Ho Chi Minh

|

|

State/ZIP:

|

( )

|

|

Country:

|

Viet Nam

|

|

Phone:

|

+84 28 6281 0430

|

|

Fax:

|

+84 28 6281 0437

|

|

E-Mail:

|

[email protected]

|

More about:

|

|

|

|