|

Photo: SalMar

SalMar Navigates Low Q1 Harvest, Eyes Stronger Volumes Ahead Driven by Robust Biomass Growth

(NORWAY, 5/22/2025)

(NORWAY, 5/22/2025)

- The first quarter was characterized by a low harvest volume where majority of the volume was harvested late in the quarter. The focus in the quarter has been to build biomass so that increased volume is facilitated later in 2025.

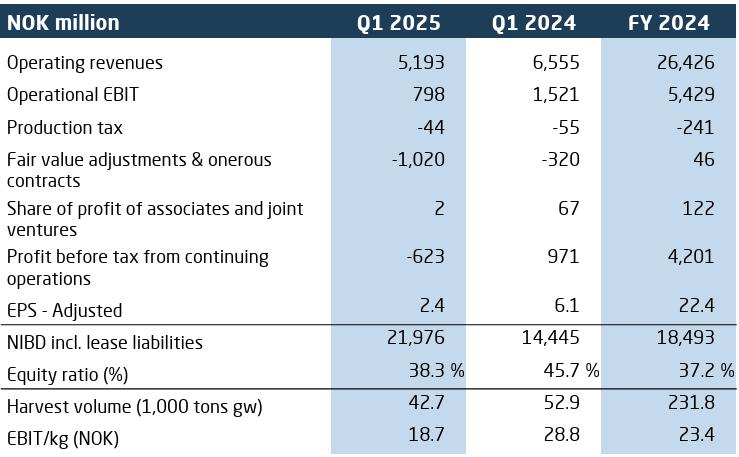

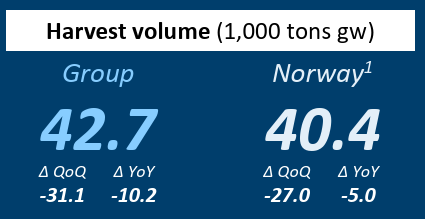

- Operational EBIT for Norway was NOK 852 million in the first quarter of 2025. The harvest volume was 40,400 tonnes and operational EBIT per kg was NOK 21.1. Operational EBIT for the Group was NOK 798 million in the first quarter of 2025. The harvest volume was 42,700 tonnes and operational EBIT per kg was NOK 18.7.

- The result from the farming segments in Norway is characterized by harvesting late in the period and that fish have been harvested as a result of fish welfare considerations, which resulted in a low average weight. Furthermore, the share of downgraded fish has been high. In sum, this has had a negative impact on price achievement in the quarter.

- Results from Sales and Industry driven by positive contribution from contracts

- As expected, Icelandic Salmon harvested a low volume, and the cost is still high.

- Scottish Sea Farms reported another good quarter with increased harvest volume, high harvest weight and good biological status in the sea in all regions.

Norwegian Aquaculture Giant Reports Modest Initial Quarter but Confident in Full-Year Outlook with Strategic Acquisitions and Healthy Biological Performance.

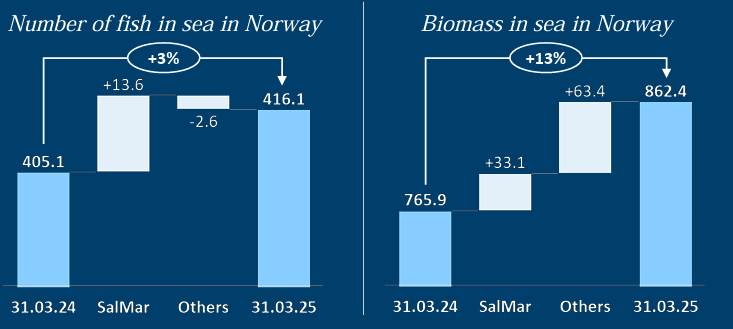

OSLO – SalMar ASA, a leading force in Norwegian salmon aquaculture, has reported a challenging first quarter of 2025 characterized by a low harvest volume. However, the company remains optimistic for the remainder of the year, pointing to strong biomass growth at sea as a key enabler for increased production.

The first quarter saw a harvest volume of 40,400 tonnes for SalMar's Norwegian operations, contributing to an operational EBIT of approximately $83.5 million (NOK 852 million). This translated to an operational EBIT per kilogram of roughly $2.07 (NOK 21.1). Across the entire group, the harvest volume was 42,700 tonnes, with an operational EBIT of approximately $78.2 million (NOK 798 million), or about $1.83 (NOK 18.7) per kilogram.

The modest financial performance in the Norwegian farming segments was largely influenced by harvesting late in the quarter and the necessity to harvest some fish earlier than planned due to fish welfare considerations. This resulted in a lower average weight per fish. Additionally, a high proportion of downgraded fish negatively impacted price achievement during the period.

Frode Arntsen, CEO of SalMar ASA, commented on the quarter's performance: "In short, we are pleased with the development in growth and survival in the sea, but financially it is unfortunately weak as a result of harvesting late in the period and the quality of harvested fish in the quarter." Frode Arntsen, CEO of SalMar ASA, commented on the quarter's performance: "In short, we are pleased with the development in growth and survival in the sea, but financially it is unfortunately weak as a result of harvesting late in the period and the quality of harvested fish in the quarter."

Diverse Performance Across Subsidiaries

Outside Norway, Icelandic Salmon reported a low harvest volume and continued high costs, as anticipated. In contrast, Scottish Sea Farms delivered another strong quarter, marked by increased harvest volume, high harvest weights, and a robust biological status across all its regions.

Strategic Expansion in Norway

SalMar is demonstrating its strong belief in and commitment to profitable and sustainable salmon production within Norway through recent strategic investments. In February 2025, the company completed the acquisition of a controlling stake in AS Knutshaugfisk, which holds 3,466 tonnes of Maximum Allowed Biomass (MTB) in licenses and operates four farming locations in production area 6 in Central-Norway.

Click on the image to enlarge it

Further reinforcing its Norwegian presence, SalMar Farming AS and Wilsgård AS announced in April that their respective boards of directors had approved a merger plan. SalMar has held a 37.5 percent stake in Wilsgård since its acquisition of NTS and merger with NRS in 2022. Wilsgård boasts a strong operational footprint on Senja, holding 5,844 tonnes of MAB in licenses across production areas 10 and 11 in Northern Norway.

"Wilsgård is a well-run company that, like SalMar, operates aquaculture in one of the best areas in the world for salmon production," Arntsen stated. "This merger will not only strengthen our position in the region but also contribute to increased operational efficiency, cost reductions, and financial robustness. We have great ambitions for the future and look forward to further developing the combination of our companies." The merger is expected to finalize during the summer of 2025, subject to regulatory approvals.

.png)

Click on the image to enlarge it

Positive Outlook for 2025

Despite the initial quarter's harvest challenges, SalMar's biological performance at sea has been robust at the start of 2025, with the company entering the second quarter with a record-high biomass for the season. This positive biological development underpins the company's decision to maintain its full-year volume guidance.

For 2025, SalMar projects a total harvest volume of 294,000 tonnes for the group, representing a 17 percent growth in harvest volume compared to 2024. This includes an estimated 256,000 tonnes from Norway, 7,000 tonnes from SalMar Ocean, 15,000 tonnes from Iceland, and 32,000 tonnes from Scottish Sea Farms (on a 100% basis, with SalMar's share accounted for).

The company acknowledges ongoing global market uncertainty but notes continued strong demand for its products. SalMar anticipates a lower global supply growth in the second half of 2025 compared to the first half, potentially offering a more favorable market environment.

The full report and presentation for the first quarter are attached.

[email protected]

www.seafood.media

Information of the company:

|

Address:

|

Industriveien 51,

|

|

City:

|

Kverva

|

|

State/ZIP:

|

(NO-7266)

|

|

Country:

|

Norway

|

|

Phone:

|

+47 7244 7900

|

|

Fax:

|

+47 7244 7901

|

|

E-Mail:

|

[email protected]

|

More about:

|

Approval / Accreditation / Certified / Oversight by...

|